Reverse Take-Over Situation

When a company engages in a RTO exercise, it is not necessary a cashing out opportunity for the new owners. To them, it may be just a valuating

activity.

Normally for RTO, you will hear the "circus" behind the team.

There will be quite a lot of news on them so people will know this counter and push up the share price.

But what happens if the RTO doesn’t have any "circus", especially on the fact

that it is so hard to find information on the company that is intending to take

over the listing? Does this meant that it is some sort of shady business? What is it all about?

That’s when the investigator in me came out.

Recently, I got caught in this mode when I wanted to invest

in a company that is currently in a RTO exercise now. The propose RTO has not been

completed. Thus, I will not be stating the company’s name. I will just name it

“ABC”.

Nevertheless I will be putting up information on this page

which are public information on SGX and the net, which you may straight away

know which counter I am talking about.

In addition it is also IMPORTANT TO NOTE that ANYTHING

WRITTEN HERE IS BASED ON MY ASSUMPTION. I MAYBE WRONG AFTER ALL SINCE NOT ALL

INFORMATION ARE REVEALED.

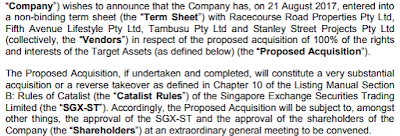

Here are some abstract from the announcement:

TL;DR:

- ABC is going through a RTO exercise with Racecourse Road Properties Pty Ltd, Fifth Avenue Lifestyle Pty Ltd, Tambusu Pty Ltd and Stanley Street Projects Pty Ltd.

- It will acquire 4 freehold properties in Brisbane and operate under a chain of properties with a concept that has been created and developed to target business owners in the beauty and wellness industry.

- There are 2 vendors. One of the vendors is an existing director of ABC and owns about 28.4% of ABC. He will eventually become a consultant for the future ABC.

- The properties has an estimated net asset value of A$9 million dollars.

- New ordinary shares will be issued at $0.035/share to the vendors.

What I found out:

Googling the 4 companies name and I found out about this - http://www.fifthavenuelifestyle.com/

In fact, this website totally tallies with the information

above.

Its business is in Brisbane and it is renting studios to the

entrepreneurs within the wellness and beauty industry in Brisbane starting at

A$295/week.

From the website, you can also see the locations for the 3

commercial properties. From the people whom travelled to Brisbane before, they

stated that these are suburb area catering to the neighborhood.

In addition, I emailed the company on 16 November and they

replied me through a 3rd party agent on 20 November.

Extract of the email is below:

Here are my thoughts:

Positive:

1. Rental income. Seems like a REIT model.

2. Pop-up stores seems to be work better for small business

owner. Lower startup cost.

3. Brisbane Property yet to fully peak.

4. The website seem to show that the company is expanding. The

extra properties will most probably come from the companies in the RTO

exercise.

5. The issue share price is $0.035. This is about more than 20%

premium about the current share price range.

Negative:

1. The website is designed in 2017. – Seriously?! This business

was established only in 2017??

2. The existing director will become a consultant – So he can

cash out and say bye bye? This does not make sense to me.

3. The number of consideration shares are not stated. In

addition, it seems to suggest that the RTO will release new shares into the

market and not a conversion of existing shares. It sounds more like a rights

exercise. Dilution?

4. The market value is an estimated figure and the exchange

rate used is rather high.

5. No moratorium period stated. Existing directors can sell off

anytime.

6. Why was the email replied via a 3rd party agent? –

Extra cost, lower profit margin!

7. Revenue calculation: 295/week/studio x 15 studios x 52 weeks (assuming 100%

occupancy) x 5 locations (As per website, they will open 2 more places) x 1.08

(Australia exchange rate) = S$1.24 Million - Too low! Furthermore I am

assuming a very positive scenario here.

In Short

I have 1000 shares of this counter. But the total value of

these 1000 shares can only buy you a few set of McDonald's meal. If you had

followed me, you will know which counter I am talking about.

Although I am vested, but with all the negativity I have

stated, I will not be adding to my holdings. I prefer to allow the RTO to take

place first and see what is actually happening behind the scene.

Lastly I will end of with these words below…

If you are interested to know more about The Ultimate Scorecard or Full Analysis, do visit the Fundamental Scorecard website for more information! Do sign up to get the latest scorecard of the SGX counters now!

Oh... and do remember, please like our Facebook page (T.U.B Investing) and follow me on InvestingNote.

Came across your site by chance and read this article. Don't really follow you but I know exactly which company you are referring to just seeing what you posted.

ReplyDeleteA few comments:

- Issue price and exchange rate were based on prevailing prices/rates as at date of initial announcement. That's why they seem high compared to what we have now. Neither an advantage or disadvantage.

- This is technically not an RTO but just a very substantial acquisition as there is no change in control. TKW will get more shares from the share issue which should result in an increased stake.

- You can estimate the number of shares issued by using approximate consideration which is based on net market value of A$8.0 mil divided by the issue price per share

- Director being reassigned as a consultant to company doesn't mean he can sell and leave. He will still be the biggest shareholder after the exercise and I do not see him just dumping his majority stake without building up the business. Otherwise, he shouldn't even bother doing the exercise at all.

- Did you check if the 3rd party answering you is a property agent? I would think that is likely the case.

- With a 1.24mil rental and 14.3mil valuation, you get a cap rate of 8.7%. This is not exactly low for a retail property in Brisbane, which is typically in the 6-8% range. I think the actual cap rate would probably be closer to 8%.

Hi Anonymous,

DeleteThank you for commenting on this post.

Maybe I did not explain my point of view properly because I am trying my best to not reveal the company. Sorry on that.

As for your comments, you did provided me another side of this story. Let me comment below:

1. The prices seem high as to what we compared to now. But if you, like me, want to purchase this counter at a price lower than its NAV, the figure in the announcement could be misleading.

2&3. I agreed on these 2 points. I might have been too negative about the whole situation to think about it.

4. I will have prefer some moratorium term. Just being stubborn on this!

5. Yes he is a property agent. Isn't it extra cost?

6. I totally understand this point. I think it is reasonable. However, I believe it is too low because the rental will end up being its REVENUE figure. I feel if selling, administrative and distribution expenses are taken into account, the revenue will be too low.

Hope this explain my points further. But I must say your words made me want to look at the company again!

Regards,

TUB

There is nothing misleading in the figure. An investor just need to be aware that the price and exchange rates used at that time are as per then prevailing rates and make adjustments accoridingly. Since the term sheet is non binding, both could be updated when the S&P agreement is signed.

ReplyDeleteI think it is pretty common for property owners to engage agents to lease out their units. It makes sense too. Otherwise, they would have to maintain a team of permanent staff just to handle leasing enquiries which would mean even higher overheads.

Moratorium for very substantial acquisitions and RTOs are a given and is required under SGX rules. It is not normally announced particularly in a non-binding term sheet.

Most companies that hold only investment properties have low revenue compared to their asset base/NAV with typically high net margins. Pure hotel operators like hotel grand central or hotel royal are good examples. It is nature of their business. You cannot use that as a singular yardstick to measure value without taking into account the asset size. In this case, the incoming net assets are only worth S$9 mil or so. It would be illogical to expect them to generate a $5 mil revenue from rental. So honestly I don't really get what you are driving at.

Hi Anonymous,

DeleteThanks for replying to the message.

What I want to explain is that what you stated are factors that many of us do not know. Thus, for those investors like me that just read and invest, they maybe on the losing end.

As for the revenue, what I am worried is that in the event the business solely consist of rental of these spaces, it may not be able to generate a sustainable net profit or FCF if we include other expenses like director fee, admin expenses... etc.

Anyway at the end of the day, i will need more information to decide if I want to invest further.

Nevertheless thanks for your information!

Regards,

TUB