Reflecting on My Investment in Digital Turbine (APPS): Assessing the Future Potential Despite Past Challenges

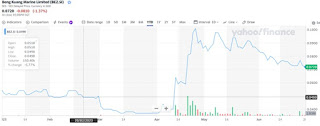

Originally intended as a paid article, circumstances led me to publish it for free on my blog instead. As a result, I kindly request your support by sharing this article and clicking on the Google Ad on the side. Your gesture would be greatly appreciated! Why I Remain Invested I was asked to share my thoughts on Digital Turbine (APPS) in light of ongoing discussions on X . As a long-term shareholder who has closely followed the company, I feel compelled to explain my rationale for persisting as an investor despite challenges. I initially purchased APPS shares around $30, witnessing the stock rise above $90 before helplessly watching it plummet to just $5 over three years. While I sold a small portion in the $8-10 range, the bulk of my position remains deeply unrealized. It once comprised a sizable allocation that has now dwindled considerably due to further declines rather than averaging down. Chart of Digital Turbine over last 5 Years. From SeekingAlpha Thus, given the neg...