Adtech - The Booming Industry

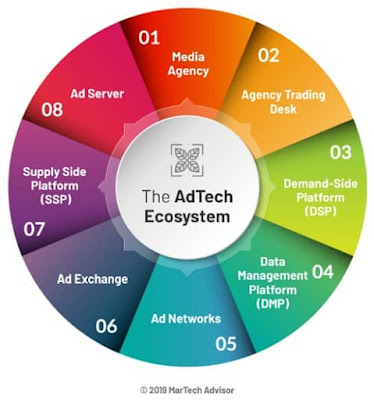

In the past, I had done a webinar on EV and also wrote about Sports betting as an industry. In my portfolio, Tesla remains the only EV company, while FuboTV being the only company that is still active in the sports betting industry. Generally 1 do not write articles on a particular sector - because I am not an expert in these industries and I definitely do not want to provide any wrong idea/information about them. However, my portfolio has been increasing its allocation towards the Adtech Industry. Image Credit: Martech Advisor Thus, I did more research for my own benefit and here are some of my opinions. Macro Views: 1. Shift from Traditional Advertising to Digital Advertising With the advent of the internet, more smartphone usage, and increased viewing on streaming channels in recent years, there has undoubtedly been a move toward digital advertising. This was more evident after the pandemic, as many of the Adtech companies hit record revenue and profit in FY2021. 2...