10X Potential: FuboTV (Ticker:FUBO)—Part 3b

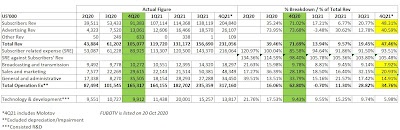

This is a continuation of the previous article . The more interesting findings are here - and also my value-added opinion. 5. Income Statement Calculation (+positive) Comparison of Income Statement QoQ In view of the breakdown of the income statement and comparing them Quarter over Quarter (QoQ) , it still seen like the figures remains volatile. After all, Fubo is only listed on 20 Oct 2020 (on 3Q20) , and the first actual financials should be 4Q20, which meant only about 5 quarters of financials has been released. By reviewing the comparison of the Income Statement QoQ (Note that non-cash items are not included. Technology and Development expenses are deemed as positive growth. Thus, separated from the calculation), do note the following: Total revenue has been growing at a faster pace QoQ since 2Q21. But the great improvement occurs from 3Q21 to 4Q21 due to the significant growth in subscriber revenue and advertising revenue. 4Q21 was also the first quart...