War Among the Titans

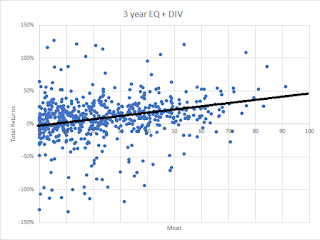

This article contains PART of my 1st Scorecard Newsletter written on 22 Aug 2018 for my Moat Scorecard subscribers. This is the 1st write up of the Scorecard Newsletter just for you, as a subscriber. This write up will comes with full disclosure on the companies that I will be discussing, even if they are in my portfolio. Do note that this write up will be reproduced on TUB Investing Blog 1 month later without full disclosure. Before I start, I like to discuss about the consequences that occurred during the Turkey-US crisis. Basically, market went down quite drastically and it caught quite us by surprise. This signifies the volatility of the current market – a simple discussion between countries can result in multiple ripples globally. This is most probably the Nth time I had said it – as a retail investor, we need to invest in a strong fundamental company to be able to avoid these ripple effect. Companies with strong moat will have strong fundamentals. With strong fund