TTJ Holdings Ltd - Another Long Overdue Update

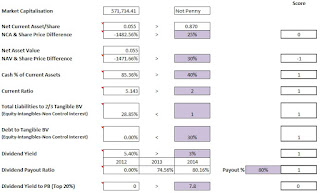

Another reader was requesting an update on TTJ Holdings Ltd. So here is the overdue post on TTJ Holdings Ltd... Please read the previous post for more information first on 28 Sep 2015. Based on the Triple S Scorecard: Although I suffered paper losses, but... 1. Cash is King - The company is still loaded with cash. As usual, having cash is important especially during period of downturn. 2. Order Book - For a construction firm, order book is important. Currently the company has an order book of $126 million with completion up till FY'18. 3. Able to Maintain Net Profit Margin - If you look closer at the profit margin breakdown above, the company is able to maintain it at 10% for the last 5 years. This is spectacular for a construction company, especially during these down times. 4. Future Projects - With so many infrastructure projects coming up, the company may have the possibility of getting more projects in future. Thus, increasing their order book ...