New Thoughts - Power Stocks

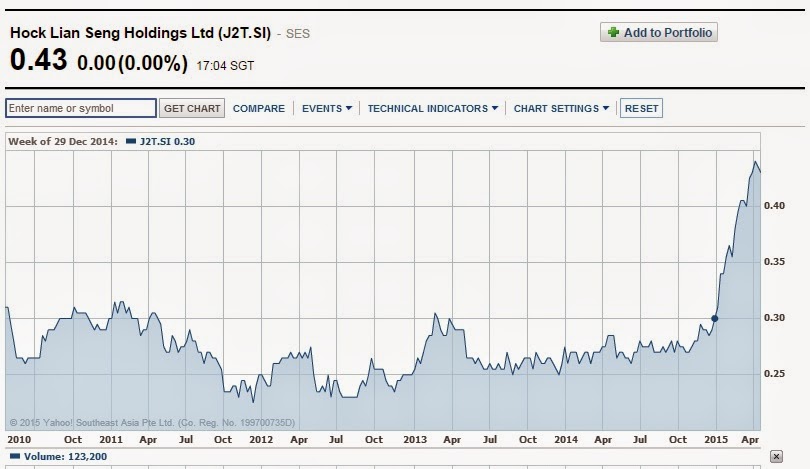

After reading this post on Net-Net Hunter, it highlights that value investing is a waiting game. You will need to wait for "someone" or "BB" (Big Boys) to realise its potential. That is also why value investor is always looking at the long term and require some form of return (eg, dividend) while they wait. In addition, I have read something else in Investing Mantras as well as this under The Moltey Fool - It suggested Warren Buffet advised us to "Invest in Great companies at fair value rather than fair companies at bargain value". After Hock Lian Seng rises to 0.40+ recently (I sold at 0.29 in June 2013), I realise I may need to enhance my approach to find "power stocks" instead of just value stocks. Thus I decided to amend my approach a bit... Additional to my current approach: (1)10 years analysis of Net Profit Margin (2)10 years analysis of Return Of Assets (3)10 years analysis of Return Of Equity If th