Worst Case Scenario of Pledge-Sell-Farm

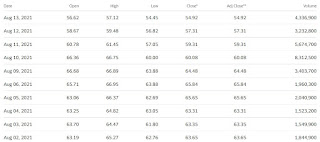

With regards to my most recent strategy post - Pledge-Sell-Farm - someone by the nick of Corgitator actually wrote a long comment in InvestingNote as per quoted below as well: "High conviction =/= high returns because hey, even the best investors make mistakes. In fact, it's the high conviction ideas that you get wrong which kill your portfolio (i.e. It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so). And if one is that certain that the company will definitely do well (nothing is definite though, investing is after all just a handicapping game), then just buying LEAPs on those companies will make you way more than writing puts and reinvesting the premiums in blue chips. Also, the strategy is what I call picking pennies in front of steamroller strategy (just like all naked option writing strategies and their variants). Your hit rate will be high, but when you do make a mistake, the damage is immense. Imagine this scenario:...