Venture Out And Explore

This actually did not catch my eyes today. After all, the portion of my SG stocks are my hedge against my US growth portfolio. It’s maxed out. However, JR_Chai asked me if I am writing a piece of article on this. This triggers some opinions in my head and I told him I will probably post them out tonight.

Warning: This is an opinionated piece. Please do not proceed if you have a heavy weightage of SG Blue Chips in your portfolio.

…

…

…

Ok I already warned you.

So what is “this” that I mentioned previously?

This is the new proposal that Capitaland has put up today.

As per CNA article, it states that “CapitaLand, majority-owned by Singapore state investor Temasek, announced on Monday (Mar 22) plans to split itself into two in a strategy aimed at pursuing growth as an asset-light company.

It is proposing to inject its real estate investment trusts and investment management unit into a separate listed Singapore entity and place its real estate development business under a Temasek unit.

The restructuring move by CapitaLand comes after it posted its first annual loss in nearly two decades in 2020, and like rival property developers, faces a tough outlook due to the coronavirus pandemic. It is one of Asia's largest real estate firms by assets with operations in Singapore, China, India and other markets.”

In my opinion, this is what I came to my mind after I reading the article – Capitaland don’t know what to do after making a loss recently. So it decide to follow SG Blue Chip Keppel, to going into fund management and become an asset light company. Asset light seem to be the “in” word now.

Basically, it continues to highlight the lack of innovation within the SG Blue Chip companies and they could have done this so much earlier to unlock value for the long-invested shareholders.

Doing it now only highlights you are at your wits end.

Same for Keppel and Sembcorp. Oil, gas and marine has already past its prime. It sure took them long enough to realise.

This brings me to another entity – ComfortDelgro.

There was a night when another friend asked me about the transport giant in Singapore. I mentioned this – When Uber and Grab came, they probably don’t think too much about it and were caught. Now that everyone is talking about robo-taxi, I still don’t see them do anything. However, I believe they will continue to do well in Singapore but they will suffer intentionally when robo-taxi becomes the norm.

This again highlights the point that SG Blue Chip tends to lack innovation. At times, I wonder why we cannot think forward like some of our non-STI SG firms.

Look at how UMS has grown or how AEM has been able to grow so fast!

I am still waiting for the chance to see a SG pure tech firm to be accepted into STI.

On the other hand, you probably feel that I am being too critical. I do also have to agree if I were in the shoes of the management, I may probably do the same thing at this point in time.

That is why when I see the change in management in Singtel – I see it as a positive move. At least it’s a start. But whether Singtel really change, only time will tell.

So for the million dollar question of “Will I ever invest in Capitaland once this restructure is complete?” I will probably say no.

This is because my SG allocation is full and I rather invest into the US market now.

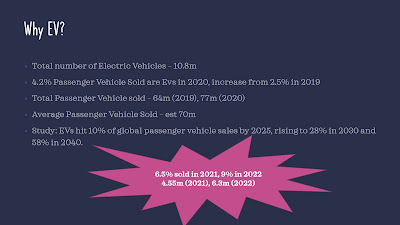

There are many emerging trends arising in the US market now – such as Igaming, Electric Vehicles (EV), 5G, Energy, Fintech, etc.

One of the main trend that I am interested in is the EV sector.

Comments

Post a Comment