Digital Turbine (APPS): Look Beyond The Short Term Pains For Amazing Gains

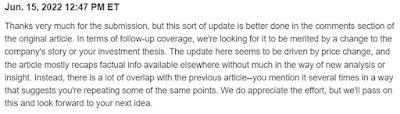

This is infuriating. Seeking Alpha has rejected my article yet again. So, if I post about the same company again, it must be a quarterly update or justified by a change in the firm's story or my investment thesis. But, unless I'm trading, why would I update the story or thesis on a quarterly basis?

My main motivation for writing this article was to reaffirm my opinion on the company now that the price has dropped substantially, and to address points that others may have overlooked.

|

| Feedback from SeekingAlpha |

So, once more... I'll post the article here for everyone to read (my 16th article on Digital Turbine as per my 10x Potential Series). Please aid by liking and sharing till SeekingAlpha understands my grievances. I worked on this article for several days. I also hope this helps to keep investors calm in this harsh market. Enjoy!

Power of SingleTap

According to the Product Lifecycle Graph below, Digital Turbine's Ignite On-Device Platform growth appears to be at the diminishing returns phase.

|

| Image taken from Exploiting Change Website |

After all, it is a revenue-at-first-boot business model that has already been implemented in over 800 million devices. It will continue to increase, but at a slower rate, because everyone will still continue to buy new phones to utilize.

As I stated in my initial piece, despite the anticipated slowdown, Ignite On-Device Platform constructed a moat around the device, allowing it to access into the device's first-party data.

In the last 2 earning calls, CEO has been placing significant emphasis on SingleTap, mentioning it 17 times in 3Q 22 transcript and 20 times in 4Q 22 transcript, as the company transitions from a revenue at first boot business model to revenue over the lifetime of device.

SingleTap is a patented product that has been deployed in over 150 million devices (according to a company blog post on 20 May 19), allowing you to install apps in the background while gaming or reading news, and reducing drop-off from installing the advertised apps.

This will be Digital Turbine's next growth phase. However, the delay in SingleTap integration caused investors to question the product's viability, especially when revenue growth has slowed in 4Q 22.

As per the CEO explanation in the 4Q 22 transcript: "It started with Verizon and then AT&T, Cricket, Samsung and Tracfone, all the rest of them, where you bring on a partner, it takes a while to bring on that partner because you got to integrate into their processes of how they do business. So a lot of these large Tier 1 players already have existing processes for how they do app installs. And so we've got to integrate into that. And we're in the process of doing that right now."

I previously invested in Smith Micro Software (SMSI), which also struggled to incorporate its product into T-Mobile's business.

In spite of the difficulty, Digital Turbine have already completed the following:

- Purchase Appreciate as the DSP to help SingleTap scale and improve its margins;

- Integrated SingleTap into Adcolony in Sep 21;

Other pending SingleTap executions are:

- Strategic Partnership with Telefonica, which will also include SingleTap (Waiting to Scale)

- Integration of SingleTap into Fyber Exchange

- Integration of SingleTap into Samsung devices (Finalizing plans now)

- Integration of SingleTap with Facebook (The hype has died down, but I do believe it is still on going)

- Integration with other Tier 1 partners (probably other telecoms operators)

As per 4Q 22 transcript, CEO has already stated that: "We are now signing contracts and entering live trial phase with many Tier 1 partners this quarter. Expect to see those begin generating revenue in the September quarter and ramping in the December quarter. Early results and interest has been encouraging, and we expect to see this as a large growth driver and a margin enhancer into the future."

As investors, we should wait it out and see if the company continue to execute since a timeframe has already been established.

Adcolony & Fyber

While everyone is focusing on the slowing growth, they have overlooked the revenue growth in the two acquisitions - Adcolony and Fyber.

|

| Fyber 1H 21 Gross Revenue from Fyber 1H 21 Interim Statement |

According to Fyber's 1H 21 interim report, net revenue is $28.3m (1Q 21: $13.7m, 2Q 21: $14.6m). If this value is extrapolated for a year, the estimated net revenue for FY21 is $56.6m.

Fyber, on the other hand, achieved a net revenue of $92.6m after being acquired by Digital Turbine on 25 May 21, over a 10 months period. This will have translated to a 63.6% increase in revenue!

|

| Otello FY20 Gross Revenue from Otello FY20 Annual Report |

|

| Information Taken from Digital Turbine Original 10Q on 8 Feb 22 |

|

| Information Taken from Digital Turbine Amended 10Q on 27 May 22 |

|

| Information Taken from Digital Turbine 10K on 6 Jun 22 |

Over a 3 quarter period, the difference between Gross Revenue before and after adjustment is $71.3m. So, the adjustment per quarter is estimated to be roughly $23.7m.

Therefore, Adcolony's Gross Revenue figure is estimated to be $264m (169+71.3+23.7). Despite advertising softness and Apple's IDFA impacting the industry, this still translates to a 25% revenue growth.

I was relatively surprised on Adcolony's revenue growth, since I had been in conversation with Mathias Mærsk, a Programmatic AdTech Manager in Azerion, that Adcolony has a higher price point. He explained that this was due to Adcolony integration with SingleTap as well as the end card feature they have on rewarded video gaming inventory. Thus, this meant that SingleTap is definitely an important function that advertisers are looking out for (Read Mathias Mærsk recent twitter thread on Google).

Both acquisitions are growing well. But, as per 4Q 22 transcript, synergies account for only at 10% of revenue currently. Therefore, with further integration between Adcolony and Fyber, investors can expect more revenue growth and cost reduction next quarter.

Stronger Balance Sheet

In my previous article, I have mentioned that Digital Turbine is a great capital allocator despite having a current ratio lower than 1.

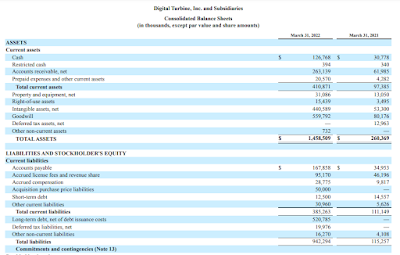

|

| Information taken from Digital Turbine FY22 10K |

According to the 10K, the current ratio is over 1.066x, the highest in the last 8 quarters. Furthermore, the $50m in acquisition purchase price liabilities has been converted to shares.

This meant that Digital Turbine would have a better balance sheet to navigate the market's current macro headwinds.

Some may argue that the debt is high. However, as mentioned in my 1st article: "...the company recorded a negative change in fair value of contingent consideration of over $40.2m, which is not recurring in nature."

As a result, there is a greater likelihood of a net positive influence on the bottom line than a negative consequence.

Risk

The primary risk to this theory is the prevailing macro headwinds.

In a hyperinflationary or recessionary economy, advertisers may reduce advertising to save money and remain competitive in terms of pricing, or simply less advertising owing to decreasing demand for their goods and services.

As an example, numerous YouTubers have reported that their profits have plummeted dramatically. This is most likely related to the reduction in advertising.

Therefore, a continuing significant slowdown in advertising may result in a significant reduction in Digital Turbine revenue as well. Eventually, this will have an impact on their net profit.

Mitigation - Next quarter revenue guidance is $183m to $187m. This is basically unchanged when compared to revenue of $184.7m in 4Q 22. As a result, the advertising slowdown will have been factored into this forecast.

Valuation

In my opinion, the share price in the next 3 to 6 months may even approach single digits as the market continues its risk off stance.

However, advertising must eventually resume, especially during the festive season or even in 2023, because as per this article from Harvard Business Review: "Companies that have bounced back most strongly from previous recessions usually did not cut their marketing spend, and in many cases actually increased it. But they did change what they were spending their marketing budget on and when to reflect the new context in which they operated."

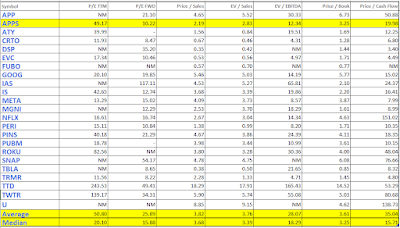

So, if you are a long-term investor over the next 2 to 3 years, you should be aware that Digital Turbine ratios have already dropped dramatically. It used to be one of the AdTech companies with higher ratios, but now all of its ratios have dropped below the average, and all but two have dropped below the median.

|

| Information Taken from SeekingAlpha |

Similar to my 1st article, I will be reviewing the EV/EBITDA. Investors can expect:

- EV of $4.8m via the average EV/EBITDA, a potential increase of 127%

- EV of $3.1m via the average EV/EBITDA, a potential increase of 48%

Nevertheless, if EBITDA is still expected to be $1bn in 2025, the EV has the potential to reach at least $18bn, a whopping 9x return!

Conclusion

Headwinds will persist, and advertising may slow further in the short term. The market will maintain its risk-off attitude, and the sell-off may continue.

However, because Digital Turbine is profitable, generates large cashflow, has minimal capex, an improved balance sheet, and its management continues to execute, the company will undoubtedly overcome this challenging phase.

When investors look beyond the short term, and as Digital Turbine becomes cheaper, it will become severely undervalued and and become "a wonderful firm at an absurdly low price."

If you had read till here and I have value-added to your investment journey, please support by clicking into the Google Ads if it interest you!

Appreciate!

Stay tuned for the next write up!

Highest conviction stock for me too. painful to watch the stock decline but continuing to DCA into APPS. Just hope the overhang of the accounting restating will pass as reading 'news' of class suit reminders is quite a bummer. Holding fast in any case! Thanks for the write-up.

ReplyDeleteHi,

DeleteThank you for the comments. I guess everyone is hurting more on a daily basis, even as from a portfolio perspective. Let's just hold on tight and give the management more time.

TUB