The Continuation of Beng Kuang Marine Turnaround Story

Not Vested

Since my last write up, Beng Kuang Marine (BKM) has seen a remarkable surge in its share price, soaring from 6.7 cents to 16.5 cents as of today. Additionally, the company has attracted a new institutional investor, which is known for delivering impressive returns. The arrival of this investor suggests that something positive is happening within the company, making it more appealing to potential shareholders.

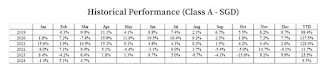

|

| Ginko-AGT Global Growth Fund Returns. Source: AGT Website |

If you’ve been following my earlier analysis of BKM, you’ve likely benefited from the recent surge in share price. However, it’s crucial to assess whether this upward trend is sustainable. To do so, we need to delve into the company’s fundamentals. After all, I believe the share price surge was driven by BKM’s successful turnaround in FY2023. It’s essential to determine if the underlying fundamentals will continue to improve.

If you're pressed for time, the bottom line is a definite "Yes."

Here's why:

1. The upcoming half-yearly results are expected to include significant gains from the sales of fixed assets. These gains will contribute substantially to the company's financial performance.

|

| Source: BKM FY2023 Annual Report |

2. Even without factoring in the gains from fixed asset sales in FY2023, which amounted to S$4.3m, BKM continues to maintain profitability at S$3.5m. Considering the current market cap of S$33.67m, the PE ratio remains at a reasonable 9.5x, indicating that the company is not overvalued.

Despite the positive factors mentioned above, there are still two additional factors that have the potential to further enhance the company's fundamentals:

1. Potential Improvement in Corrosion prevention segment

One of BKM's recurring businesses is its involvement in as a corrosion prevention contractor for FPSO and FSO, particularly as a residential contractor in various shipyards. With the introduction of numerous new FPSOs in the market, there will be an increased demand for maintenance services, which BKM is well-positioned to provide. Revenue in this segment has already shown growth from 2021 to 2023. However, the net profit has declined significantly, likely due to increased raw material costs within the corrosion prevention segment.

|

| Source: BKM FY2023 Annual Report |

It appears that zinc serves as a raw material for the Corrosion Prevention segment, and its price has remained elevated throughout 2022 and 2023.

|

| Source: Business Insider Website |

It appears that the price of zinc has declined in 2024. Furthermore, if BKM can enhance the efficiency of this department, it has the potential to establish a recurring business model with growing net profit to its overall profitability. The recent appointment of a new executive also holds promise for further positive developments.

2. Ability to Refinance at Lower Interest Rate

While the exact interest rate on its borrowings is unknown, the interest expenses in FY2023 amounted to S$1.8m, and the total borrowings (including non-trade payables from non-related parties) amounted to S$15.4 million (S$14.1m + S$1.3m), suggesting an estimated combined interest rate of approximately 11.7%. If BKM can refinance these debts at a lower interest rate, the savings on interest expenses will positively impact its bottom line.

Conclusion

It seems that the fundamental improvements in BKM are expected to be sustainable at least until the next reporting period, suggesting that there is still room for the share price to grow. However, for the company to achieve even greater gains, it will be crucial for them to effectively steer their Corrosion Prevention segment towards a path of growth and successfully refinance their debt at a lower interest rate. If these objectives are accomplished, there is a strong likelihood of witnessing another significant leap in both the company's overall fundamentals and its share price.

I am currently working on a new project. Let’s see if it can come to fruition in due course.

Follow me on X for the latest update.

Stay Tuned.

Comments

Post a Comment