Free Cash Flow Is Going To Cost You

Investing can feel like you’re at war sometime. And while there are no silver bullets that can help you choose the best company to invest in, many (claim to) have found potent ammunition in free cash flow (FCF).

FCF refers to the cash, a company has remaining after deducting its capital expenditure, that can be used to repays creditors, or as dividends to investors. At the risk of oversimplifying this, it generally measures what a company can return to its equity investors, if it has no debt — which is exactly what you are looking for as an investor. FCF is also a widely used metric in investment banks and hedge funds, making it seem like a reliable weapon to add to your arsenal for financial analysis.

|

| Source: Yahoo Finance |

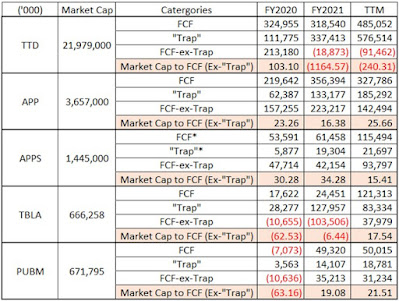

To me, it sounds more like a glamorous piece of silver laid in front of a trap. Just look at the top ad tech firms over the past 3 years. By accounting for this “trap”, many of the most attractive companies to invest in, such as The Trade Desk, sink into complete oblivion. But what single metric could be responsible for tying a portfolio up in so much red?

That “trap” is Stock-Based Compensation (SBC). SBC is a way of paying employees, executives, and directors of a company with equity. More importantly, it is not deducted from FCF which might make sense for an accountant but makes little to no sense for an investor like you. As an investor, you are using FCF to determine not just how much you might get back in dividends, but also how well a company is utilising its monetary resources. This includes if the money spent on employees nets benefits for the company. By keeping SCB in your FCF analysis, you are saying that the company will be able to stop paying employees in the future without losing them, or that it can continue to give away more equity without affecting value per share. Neither of these assumptions are realistic or helpful to your portfolio.

There is little writing on the wall for FCF-based analysis that does not deduct SBC because it is still a very contentious matter. In fact, many institutional investors still do not make the correction. However, we hope that this article serves as warning and at least helps you err on the side of the caution while you fight for a better performing portfolio.

For a more detailed explanation on why you should remove FCF from SCB, you can click here. Otherwise, do stay tuned. We have a bunch of very unique drops coming this January.

I agree. Unfortunately, even the best tools out there (e.g. Koyfin) don't have a FCF (ex SBC) metric or yield...but maybe that creates a (small) edge for the conscientious investors ;)

ReplyDeleteHi OnlyStocks,

DeleteAppreciate your comment. You are the one on Twitter right? Nevertheless, please wait for the the tool I am creating. hopefully it helps.

Regards,

TUB