Although returning to write on the Seeking Alpha platform presented a challenge, I was able to gather the motivation to share my thoughts on a micro-cap company. But the article was still rejected due to the limited liquidity of the stock.

Rejection does not equate to failure; rather, it provides a chance to refine and create better content. Even though Seeking Alpha didn't publish my article, I've decided to share it here instead. Thank you for taking the time to read my work.

The Company

IDW Media Holdings (IDW) is a leading American publishing company specializing in comic books, graphic novels, and trade paperbacks. Founded in 1999, IDW has built a reputation for producing high-quality, innovative content that appeals to a wide audience. With a focus on licensed properties and original titles, IDW has a portfolio of beloved brands that have captured the imaginations of readers around the world. These include the new Netflix hit Locke & Key, the ever-popular classic Teenage Mutant Ninja Turtles and more "fringe" pieces such as 30 Days of Night and The Crow.

Rewards

Locke-ing In On A Megatrend

There is a massive shift towards digital streaming services, which has been accelerated by the ongoing streaming war. With the increasing popularity of streaming services like Netflix (NFLX), Disney+ (DIS), and Amazon Prime Video (AMZN), traditional cable TV has been declining in popularity. This trend has been further accelerated by the COVID-19 pandemic, as more people have been staying at home and seeking entertainment options. As a result, there is now a high demand for quality content that can be streamed online, and companies that own valuable intellectual property (IP) are well-positioned to benefit. As the creators of many classic and upcoming hits, such as Netflix's "Locke and Key", IDW has sealed its place as a reputable IP hard-hitter in a baseball stadium full of deep-pocketed streaming service executives.

Standalone Stories

One advantage that IDW's publishing arm has over larger companies such as Marvel is that it tends to focus more on creating standalone comics and graphic novels, rather than building out a large, interconnected universe. Larger franchises such as Marvel are famous for their sprawling, interconnected universe of characters and stories, with dozens of ongoing series that tie into each other and contribute to a larger overall narrative. While this approach has been incredibly successful, it can also be intimidating for new readers who may feel like they need to have an encyclopedic knowledge of the entire comic universe in order to enjoy a particular series or storyline.

IDW, on the other hand, tends to focus more on creating standalone stories that don't require any prior knowledge of the characters or setting. For example, IDW has published successful series based on properties like Teenage Mutant Ninja Turtles, Ghostbusters, and My Little Pony, but these series are largely self-contained and don't require readers to be familiar with the larger continuity of the franchise.

This approach can make IDW comics more accessible and appealing to new readers, who may be put off by the daunting prospect of diving into a complex interconnected universe. It also allows IDW to take risks and try out new concepts and storylines without having to worry as much about how they will fit into an established continuity. In the context of a streaming war, this equips IDW with the ability to come up with a new weapon that potentially could take over and lead them to victory.

Flywheel Strategy

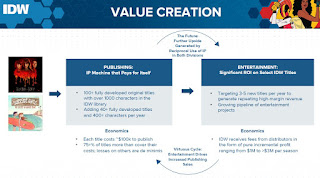

Unlike their pizza-loving fictional turtle counterparts, IDW is not resting on its laurels. According to a recent Sep 2022 Media Investor Presentation by the company, IDW is implementing a flywheel strategy that will iteratively create and fund new hits. Combined with its unique ability to experiment, this strategy could help IDW capitalise on the law of large numbers to create a few profitable hits that will erase their almost guaranteed, more frequent flops.

|

| Source: IDW Presentation |

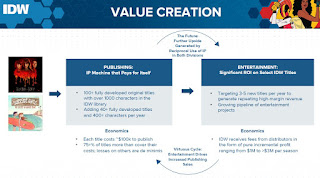

While the flywheel strategy is new, it seems to have been met with tailwinds. The company recently

announced that five of its stories have been optioned by streaming services, with an

additional six stories in development. This indicates that there is a growing interest in IDW's IP and its potential for future revenue generation. To add to that, its previous IPs have been adapted into successful movies and TV shows,. For example, the popular Netflix series "Locke & Key" is based on a comic book series published by IDW, and the show has been renewed for a second and third season.

|

| Source: IDW Presentation |

Risks

Management Change

However, investors should consider the risks associated with IDW. In December 2021, the company announced that its CEO,

Ezra Rosensaft, was stepping down and would be replaced by Allan Grafman, who served as a member of IDW's board and chairman of its audit committee since 2019 andis the founder and CEO of media consulting firm All Media Ventures.

While Rosensaft had only been in the role for a little over a year, his departure was unexpected and could potentially impact the company's future strategy and execution. It remains to be seen how the change in leadership will affect the company's direction and plans for growth.

Popularity of New IP

Another risk for IDW is the uncertainty around its spending on creating new IP. While the company's strategy of creating and selling IP fits well with the current market trend, the cost of creating new content can be significant if the investment does not take off. This is especially true given the competitive landscape of the entertainment industry, where many companies are vying for attention and investment. One prominent example is

Quibi, a mobile-only streaming service that launched in April 2020 with a focus on short-form content. Quibi invested heavily in creating original content, with plans to release over 175 original shows in its first year. However, despite attracting high-profile talent and significant investment, the platform failed to gain traction with viewers, and the company announced in October 2020 that it would be shutting down.

Losing of Licensed Deals

Furthermore, IDW tend to push its writing for licensed franchises into more controversial topics, such as exploring characters from marginalized communities, including characters who are Black, LGBTQ+, and disabled. This was

highlighted in an article as they will lose the Transformers and GI Joe licenses at the end of 2022. If becoming a voice for the edgier styles and topics in society is part of IDW's corporate strategy, I fear that this could backfire and make it a lightning rod — attracting creators that seek to toe the line dangerously close when it comes to topics that are naturally divisive. In another example, one of IDW's key writers was also

exposed for calling September 11 mourners " Self-Centered National Tragedy Remembrance from People Who Weren't Even Anywhere Near New York City Day".

While it's important for companies to take a stance on important social issues, it's also important to consider the potential impact on their business and stakeholders. What we want is a strong brand that brings in predictable profits, and not a company that supports unhinged content masked in the guise of artistic freedom.

Financials

As of its most recent 10K filing for 2022, IDW had a strong balance sheet with no debt and $10 million in cash and cash equivalents on hand.

|

| Source: IDW 10k |

This provides the company with financial stability and flexibility and makes it less likely to face bankruptcy or default on its debt obligations in the current high interest rate environment.

However, as per its income statement, the company's operating costs are high and that has caused IDW to run into slight losses of $748k in 2022.

|

| Source: IDW 10k |

Even if we included the non-recurring SG&A of $700k that is stated in its latest transcript, and the removal of depreciation and amortization, IDW will barely be profitable at $294k. Please do note that this is the case even after recognising a revenue of $4.8 million for the delivery of Season 3 of Locke & Key in the 4th quarter of 2022.

Valuation

Investors should be aware that the company in question is currently operating at a loss. Hence, it is more appropriate to use the "cigar butt approach" by evaluating the company using its book value, as calculated by its balance sheet. With a market cap $14.55 million, as per 19 Feb 2023, I believe that IDW is relatively undervalued using this method. In addition, the net current asset value is $1.36, which presents a 30% upside when compared against its share price of $1.03.

However, investors should also be aware that there is a risk associated with this method of valuation. Specifically, it relies on the company's liquidation value, which is what the company's assets would be worth if it were to be liquidated. In reality, the value realized in a liquidation scenario is often less than the company's book value, as assets may be sold at "fire sale" prices. Therefore, investing in this company based on its book value only serves as a form of protection against potential future losses or further weakening of the company. Investors should carefully consider these factors before deciding whether or not to invest in this company.

Ending Remarks

Overall, IDW presents a high risk/high reward opportunity for investors. The company's focus on creating and selling IP fits well with the current market trend, and its recent success in adapting its IP into options for movie and TV shows demonstrates the value of its strategy. On the other hand, the strategy will be based on the execution from a new CEO and that remains uncertain. Nevertheless, its strong balance sheet provided some protection against poor execution since the net current asset value remains 30% above the current share price.

This was written by Ram and TUB.

Stay Tuned.

Comments

Post a Comment