TUB Assert - Beng Kuang Marine Turnover is Almost Complete!

Vested.

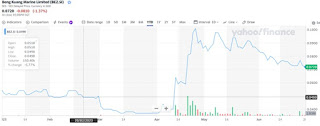

I have previously written about Beng Kuang Marine (BKM) on two occasions. Following my February 2023 article, I stated that the industry outlook would be favorable for BKM. Subsequently BKM's share price rose from $0.049 to $0.072, a gain of 46%.

|

| BKM Share Price. Source: Yahoo Finance |

I also wrote a series of tweets on my Twitter account (follow me!) about oil prices, which I believe will remain at least flat until December 2024. This will further benefit BKM's business as more FPSOs will be brought to them for maintenance.

However, after the article, the full year results were released and showed significant losses from operations. Equity fell from $18 million to $4 million. The current ratio was less than 1.

|

| BKM FY2022 Income Statement |

|

| BKM FY2022 Balance Sheet |

But if we focus on the positives, net cash from operations was actually positive. Liabilities reduced, especially borrowings. And revenue increased.

|

| BKM FY2022 Cashflow Statement |

On April 12, 2023, BKM sold 1/3 of its Batam shipyard for $8.6 million. On June 23, 2023, BKM sold another 1/3 for $9.895 million.

There were six interesting aspects of the reports:

- Based on the unaudited management accounts of the Seller for 31 December 2022, the total net book value of the Land that were sold is S$5.311m. The Consideration represents a S$12.902m excess over the net book value of the Land as at 31 December 2022.

- The term of the lease for the Batam Shipyard expires on 18 April 2037, and has been fully paid in advance.

- The Land has a total area of 100,970 square metres which is approximately one-third of the total land area comprising the Batam Shipyard.

- The fair value of the Batam Shipyard (comprising the land and the buildings) as at 16 January 2023 is IDR 411,506,600,000 (being S$35.30million).

- The fair value of the Lands that were sold were S$19.69m

- The Land comprises part of the Batam Shipyard that has remained under-utilised since FY2014 due to downturn in the offshore oil and gas sector.

These were interesting because:

- BKM is likely to report the $12.9 million gain as profit in its upcoming HY2023 financial results likely around August 12, 2023. Even if the gain is not reported in the HY2023 results, it will certainly be reported in BKM's FY2023 results released next year.

- Other than the commission paid, there were no additional costs associated with the sales. As a result, BKM will be able to use the S$18.495 million in cash proceeds to pay down debt. With debts totaling around S$22 million as of December 2023, most of the debt will be repaid. This will significantly increase the current ratio above 1 and greatly improve equity levels as well.

- BKM will also record an additional revaluation surplus of over S$15 million in its income statement and balance sheet for either HY2023 or FY2023.

- The Batam shipyard was already underutilized. Therefore, the sales did not have a detrimental impact on BKM's existing operations.

Great news continues to come in as of 28 Jun 2023 - in addition to previous positive developments, the two tugboats responsible for causing significant losses have been sold for approximately S$2m. Now that they have been sold, BKM can put the money from the sale to good use.

In summary, BKM's market cap remains under S$15 million at this point in time, even though they have recouped almost S$12.9 million in profit from selling the lands. It is important to note that the sale will also significantly improve BKM's balance sheet. With these positive developments, it's expected that BKM's turnaround will be fully accomplished this year.

Stay Tuned for the next TUB Assert.

Comments

Post a Comment