Cordlife Group's Prospects Hindered by Industry Headwinds

I was going through some old documents and found my receipt showing that I had previously paid Corvyiva's services. As a new dad, Corvyiva provided an alternative form of insurance for my loved ones. Cost was not the primary concern, but when competition exists price war inevitably follow. Fundamentally, I chose Corvyiva at that time due to their offering the same service at a lower price point.

It is worth noting that there is also a publicly traded company that provided similar services in the commercial storage of umbilical cord blood stem cells. Cordlife Group Ltd (CGL) lists on the SGX. I recall placing the company on my watch list when I began blogging in 2015, though I ultimately did not invest.

|

| Cordlife Logo |

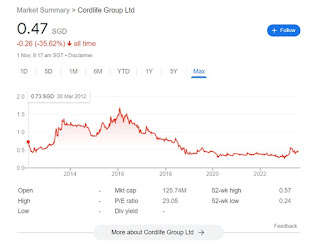

As the company's share price has noted better periods in the past, I was fortunate in my decision.

|

| From Google Finance |

Moving forward, it may be interesting to analyze CGL current business model to determine whether re-adding the firm to my portfolio watchlist is merited.

Positives

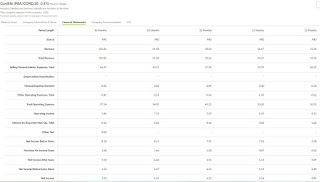

Examining the income statement reveals that revenue has declined nearly 50% from its peak in 2018. However, the company has managed to maintain a relatively stable level of net profit over the years. The balance sheet presents as very robust, with virtually no debt beyond lease obligations and over 30% of assets comprised of liquid cash reserves.

This balance sheet strength indicates the business operations are not inherently complex or costly to maintain. Given it primarily entails storage services with predictable demand, CGL is able to remain profitable despite significant revenue decreases compared to FY2018. Furthermore, capital expenditures are largely one-time costs that can generate income for years thereafter. This ability to efficiently convert revenue into strong cash flow has built the sturdy financial position reflected on the balance sheet.

While top-line growth has stalled, CGL conservatively managed operations have protected profitability and allowed accumulation of surplus cash.

|

| From SGX Website |

Negatives

The revenue decline may have resulted from intensifying competition and price wars within the industry. According to article, CGL and Stemcord initially dominated the private cord blood storage market in the early 2000s. However, when Coryviva entered in 2014 and SCCB started private services in 2017, they likely captured significant market share due to offering comparable services at lower price points. If the public began viewing these services as similar, the most cost-effective options would naturally gain favor.

In addition, a general trend of falling birth rates could have also contributed to weaker demand over time. While the business demand may seem predictable, declining national births present a macro headwind to reviving revenues. Thus, this external factor likely impacted and will continue to impact CGL top-line performance as well.

|

| From Singstat Website |

The flat net profits against declining revenues potentially also explain why dividends have remained stagnant between 2014-2022, starting at 1 cent and currently at an even lower amount of 0.9 cents. Interestingly, the company's robust balance sheet provided an opportunity for CGL to adopt a more shareholder-friendly stance. But that didn't happen. Pursuing strategic growth initiatives or increased dividend payouts could have benefited investors given CGL strong financial position.

|

| From SGX Website |

Closing Thoughts

In summary, CGL's performance appears substantially influenced by both intensifying competition within the industry and declining birth rates nationally. While profitability has been maintained even through revenue declines, robust long-term growth prospects seem limited under these demand headwinds.

For me to consider an investment, the share price would need to trade at a significant discount to book value, perhaps around a 0.7x price-to-book ratio. Given alternate prospects available both locally and abroad, I do not plan to reinstate CGL on my watchlist following this review. Opportunities with brighter long-term growth potential, stronger competitive advantages, or wider margins of safety are likely available elsewhere.

Stay Tuned.

Comments

Post a Comment