Revisiting Beng Kuang Marine: Profitability, Disposals, and Potential Opportunities

Not Vested. Considering.

In my previous blog posts, I mentioned Beng Kuang Marine (BKM) a few times. I initially held a position in the company but divested when its share price increased significantly, as it was only a small portion of my portfolio. Based on my recent review of my portfolio strategy, I am not planning to reinvest in BKM unless it is solely for a separate trade outside of my portfolio.

The current circumstances seem to indicate a potential opportunity has arrived.

To summarize the situation:

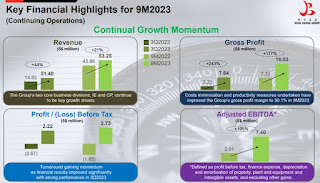

- BKM has achieved profitability based on its Q3 FY23 results. This suggests that it is highly unlikely for FY23 to be a year of losses for the company.

|

| Source: BKM 3Q & 9m2023 Corporate Highlights |

- Furthermore, BKM has successfully completed the disposal of its tugboats and has received the remaining S$460k in cash. This means that the company's financial results will no longer be negatively impacted by this unprofitable segment of its business

- In addition, BKM has collected all the proceeds from the sale of its shipyard, amounting to S$17.5m. The Batam shipyard was already underutilized, so the sale will not have a detrimental effect on BKM's existing operations.

As previously mentioned, the funds from this disposal will be used to repay debts, resulting in a significant improvement in the current ratio, equity levels, and a lower debt-to-equity ratio. It is worth noting that the current share price level keeps the market capitalization below S$13.55m. This will lead to the price-to-book ratio and price-to-earnings ratio to be very low, since that the company is expected to be profitable, along with the expectation of reporting a gain on assets of over S$10m to S$15m.

Recently, BKM has experienced a significant rise in its share price, akin to a dormant beast awakening, particularly after insiders made purchases following the completion of the partial sale of the Batam Shipyard. Nonetheless, the share price has retraced, and from a technical analysis perspective, it appears that there is some level of support at the current share price. Then again, this is an observation from someone who has zero knowledge of TA.

|

| Source: Investing Note |

Therefore, it appears to be an opportune moment to participate at this juncture.

However, it’s important to note that the positive developments, such as the completion of the tugboat sale and shipyard sale in Jan 2024, might not be reflected in the year-end results reported at the end of Feb 2024 or early Mar 2024. Additionally, BKM is currently on the SGX watchlist but have a 36-month cure period from 6 Jun 2023.

Finally, another aspect to consider is the potential for a dividend payout if all goes according to plan. Even a modest amount, like S$0.001, could serve as a delightful bonus.

Follow me on X for the latest update.

Stay Tuned.

Comments

Post a Comment