Big Idea 13

As indicated in my last post, I had already sold Big Idea 5. Therefore, I am still on the lookout for the next idea to invest in.

Currently, for my Big Ideas Investing Theory, I have wrote about 12 Big Ideas and I had sold about 3 of them. Overall, I am still holding on to 9 of them which contributes about 60% to 70% of my portfolio.

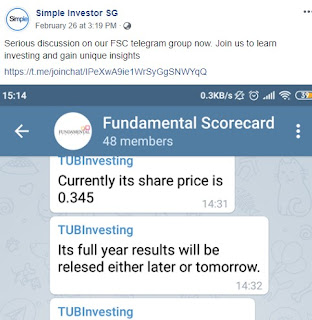

I caught a glimpse of Big Idea 13 on a valuebuddies forum. Then I went to work on it. I was so excited about this idea that I shared it on my Fundamental Scorecard Telegram Group.

Then, Simple Investor shared it on his Facebook Page.

OMG...this ballooned the members on my Fundamental Scorecard Telegram Group from 48 members to the current 130 members within 2 days. I am still very amazed by the support and will like to still say a Big "Thank You" to the old and new members in the group.

So after my initial analysis on Big Idea 13, I came up with this summary.

"The company has 2 business entity - Semi-con and CEM.

Last year FCF due to Semi-con. CEM still loss-making.

Recently they sold and completed the Semi-con business of 14 million for 84 million.

Current NAV is 20 cent at about 45 million.

84 + 45 = 129 million / 56cent per share.

As per disposal report, they will give out 24 cents as special dividend (May or may not eventually)

Current share price is 34.5 cents.

Full year result should be announced soon.

The one-time gain on disposal will be huge.

If want to keep for long term, I am not so sure. But short term, share price should spike up.

Please DYODD."

That night, the company released its full year results.

It seems to indicate that I made a MISCALCULATION in my Net Asset Value. Instead of 56 cents, it is just 37 cents. Oh No!

Currently, for my Big Ideas Investing Theory, I have wrote about 12 Big Ideas and I had sold about 3 of them. Overall, I am still holding on to 9 of them which contributes about 60% to 70% of my portfolio.

I caught a glimpse of Big Idea 13 on a valuebuddies forum. Then I went to work on it. I was so excited about this idea that I shared it on my Fundamental Scorecard Telegram Group.

Then, Simple Investor shared it on his Facebook Page.

|

| Screengrab of Simple Investor Facebook Page |

So after my initial analysis on Big Idea 13, I came up with this summary.

"The company has 2 business entity - Semi-con and CEM.

Last year FCF due to Semi-con. CEM still loss-making.

Recently they sold and completed the Semi-con business of 14 million for 84 million.

Current NAV is 20 cent at about 45 million.

84 + 45 = 129 million / 56cent per share.

As per disposal report, they will give out 24 cents as special dividend (May or may not eventually)

Current share price is 34.5 cents.

Full year result should be announced soon.

The one-time gain on disposal will be huge.

If want to keep for long term, I am not so sure. But short term, share price should spike up.

Please DYODD."

That night, the company released its full year results.

|

| Portion of the full year results |

I apologized to the group and continued to do my homework for the next 2 days. After all, I am already vested at this point (The impatient me...and the information below could be biased).

What Did I Found Out?

1. The Company had completed the sales its Semi-Conductor Business at S$84.5 Million (Actual Sale Price). The company is left with its Contract Equipment Manufacturing (CEM), which is loss-making for the last 3 years.

2. 80% of the Actual Sale Price amounted to S$67,600,000 was paid to the Company along with the reimbursement of S$8,000,000 for the cash left by the Company in Semiconductor business.

3. 20% of Actual Sale Price of S$16.9 Million is subjected to the following condition as per its Sales and Purchase Agreement:

a. "...the Purchaser will engage an accounting firm to conduct an audit on the cumulative revenues of the Target Group from 1 January 2018 to 31 March 2019 (the “2018 Revenue”). Should the 2018 Revenue be less than 80% of the cumulative revenue for the period from 1 January 2017 to 31 March 2018 (the “2017 Revenue”), an amount equal to the difference between the two will be deducted from the Escrow Amount and be released by the Escrow Agent to the Purchaser..."

b. "...If the amount to be paid to the Purchaser, as a result of the occurrence of any or both the aforesaid events, is less than 10% of the Actual Sale Price, an amount equal to the difference of the two will be released by the Escrow Agent to the Seller..."

c. "...Should the Deducted Amounts be less than the Escrow Amount, the remaining balance or the balance 10% of the Actual Sale Price, as the case may be, will be held by the Escrow Agent to settle any claim by the Purchaser in relation to a breach of the Share Purchase Agreement against the Seller (the “Escrow Remaining Amount”). The Escrow Remaining Amount will be held in escrow for a period of 18 months from the date of Completion (the “Escrow Claim Period”), and subject to any applicable claims being settled, be released to the Company upon the expiry of the Escrow Claim Period..."

4. Under the Sales and Purchase Agreement, it is also stated:

a. "...The net proceeds from the Proposed Disposal, after deducting all costs and expenses, 5% commission payable for deal introduction and financial advisory services, staff retention and compensation and assuming that the full amount of the Estimated Sale Price of S$84,500,000 is received by the Company, are estimated to be approximately S$77,100,000..."

b. "...intends to return the entire net proceeds from the Proposed Disposal to its shareholders by way of a special dividend or capital reduction, as the case may be. It is anticipated that a first distribution of 24 cents per share based on the first payment received by the Company upon Completion (i.e. 80% of the Actual Sale Price) will be made by the Company as soon as practicable after Completion has taken place..."

5. Number of Shares the company has is 233,916,970 (Round up to 234 Million).

6. Investment Properties is stated at cost and the valuation is much higher. This is indicated on Annual Report 2017.

|

| Abstract from Annual Report 2017 |

7. As per an 2018 analyst report from CIMB, it is stated the following:

"In the Contract Equipment Manufacturing (CEM) business, the company's key subsidiaries are i.PAC Manufacturing Pte Ltd (Unlisted), and AMS Biomedical Pte Ltd (Unlisted). i.PAC Manufacturing and AMS Biomedical provide modular and full turnkey assembly, system integration, reliablility testing, packing and distribution services for dierent industries.

1. i.PAC Manufacturing 's depth of expertise in mechanical, electronics and electrical engineering also embraces vision systems and laser technology, enabling it to handle wide ranging complex projects across multi-electronic sectors such as in displays, semiconductors, storage media, aerospace, solar and other high-tech capital equipment industries.

2. AMS Biomedical , with its ISO9001 and ISO13485 accreditation, is a leading choice as a contract manufacturer of medical equipment and devices, specically for the medtech industry, according to management."

8. As per 2018 full year results, the following has been stated about the CEM business:

a. "In contrast, the S$18.71m sales for the remaining CEM business represented a significant 52% growth over the previous year. This was due to new customized automation contracts and strong build-to-print sales."

b. "We will focus on getting new customers in the built-to-print area in order to achieve greater stability in our top-line. We also expect further growth in the customised automation area as there are a few promising projects in the pipeline."

9. In addition, as per 2018 full year results, it seems that the loan of S$7 million has already been paid.

Why Did I Continue To Stay Vested?

1. Dividend to be paid out soon = 67.6 Million / 234 Million = 28.8 cents.

- At this point, we knew the net proceeds will be returned to shareholders and at least 24 cents will be given first.

2. Investment Properties Net Worth = 11.5 Million / 234 Million = 4.9 cents.

- A lower valuation is used for calculation.

- About $600k of rental income is generated.

3. Cash Net Worth = 1 Million / 234 Million = 0.4 cents.

- The company has at least 1 Million of cash left. The company has been reimbursed with 8 Million of Cash and has also paid off a loan of 7 Million.

4. Will the 10% of the Escrow Amount be released after 31 March? ~ Based on my very conservative calculation, it seems that this will not occur.

- 2018 Revenue of Target Group = 36.3 Million (I deem Dec 2018 till Mar 2019 to have no revenue in order to be conservative.)

- 2017 Revenue of Target Group = 53.6 Million + 5.4 Million = 59 Million (I deem Dec 2017 till Mar 2018 to be 30% of the revenue of Half Year 2018 Financial Report.)

- 80% of 2017 Revenue minus 2018 Revenue = 10.9 Million.

5. Present Value of 2nd portion of Escrow Amount = (4.225 Million / 234 Million)/1.15 = 1.5 cents.

- For the 2nd portion of the Escrow Amount, lets just assume only 5% is released after 18 months.

- Discount given to the 2nd Portion of Escrow Amount = 15%

Deem Estimated Value Of Big Idea 13 = 28.8 + 4.9 + 0.4 + 1.5 = 35.6 cents.

What Are The Risk Involved?

1. No Escrow amount are paid out. Only 24 Cents or less of Dividend are paid.

- Despite all the information being stated in the reports, we cannot be certain that all the stated dividends will definitely be paid without any confirmed dividend announcement.

2. CEM Business continues to be loss-making for a long time.

- CEM Business has been loss making for the last 3 years despite growing top line. We cannot be certain the CEM Business will just turnaround.

3. Significant Cap-ex is required.

- From the 2018 full year report, it seems that the company's fixed asset will be sold along with the Semi-Conductor business. Without machinery, the CEM business will not be able to continue. Thus, we should be expecting some capital expenditure to occur in future.

4. My Calculation Is Wrong.

- My Calculation comes along with many assumptions. Thus, any changes in the assumption will result in the changes the Value of Big Idea 13.

In Short

When my initial thesis on Big Idea 13 was wrong, I panicked and quickly checked back. As I explained to the members of the Telegram Group, the attractiveness of the company has reduced significantly after I checked back. If it was a "10" at the start, it has since reduced to a "6".

But I remained vested due to the above calculation and that, despite being loss-making, we will be getting the "revenue growing" CEM business for free.

One of the point that was not discuss above is that there is a growing inter-segment revenue between the Semi-conductor and CEM business as per 2017 Annual Report. Furthermore, there is a high possibility that the Chairman and Managing Director of the Company, one of the key employees, will be entering into a three-year retention employment contract with the sold Semi-Conductor Business.

No idea comes without risk. But they must be calculated risk.

Oh... I have yet to announced the company's name - It is Manufacturing Integration Technology Ltd.

Please do your own due diligence before you invest this counter.

If you are interested to know more about The Ultimate Scorecard or Full Analysis, do visit the Fundamental Scorecard website for more information!

We have also released the Moat Scorecard with InvestingNote. Do take a look!

Oh... and do remember, please like our Facebook page (T.U.B Investing) and follow me on InvestingNote.

Deem Estimated Value Of Big Idea 13 = 28.8 + 4.9 + 0.4 + 1.5 = 35.6 cents.

What Are The Risk Involved?

1. No Escrow amount are paid out. Only 24 Cents or less of Dividend are paid.

- Despite all the information being stated in the reports, we cannot be certain that all the stated dividends will definitely be paid without any confirmed dividend announcement.

2. CEM Business continues to be loss-making for a long time.

- CEM Business has been loss making for the last 3 years despite growing top line. We cannot be certain the CEM Business will just turnaround.

3. Significant Cap-ex is required.

- From the 2018 full year report, it seems that the company's fixed asset will be sold along with the Semi-Conductor business. Without machinery, the CEM business will not be able to continue. Thus, we should be expecting some capital expenditure to occur in future.

4. My Calculation Is Wrong.

- My Calculation comes along with many assumptions. Thus, any changes in the assumption will result in the changes the Value of Big Idea 13.

In Short

When my initial thesis on Big Idea 13 was wrong, I panicked and quickly checked back. As I explained to the members of the Telegram Group, the attractiveness of the company has reduced significantly after I checked back. If it was a "10" at the start, it has since reduced to a "6".

But I remained vested due to the above calculation and that, despite being loss-making, we will be getting the "revenue growing" CEM business for free.

One of the point that was not discuss above is that there is a growing inter-segment revenue between the Semi-conductor and CEM business as per 2017 Annual Report. Furthermore, there is a high possibility that the Chairman and Managing Director of the Company, one of the key employees, will be entering into a three-year retention employment contract with the sold Semi-Conductor Business.

No idea comes without risk. But they must be calculated risk.

Oh... I have yet to announced the company's name - It is Manufacturing Integration Technology Ltd.

Please do your own due diligence before you invest this counter.

If you are interested to know more about The Ultimate Scorecard or Full Analysis, do visit the Fundamental Scorecard website for more information!

We have also released the Moat Scorecard with InvestingNote. Do take a look!

Oh... and do remember, please like our Facebook page (T.U.B Investing) and follow me on InvestingNote.

Thansk for the info. And many thanks for sharing the link to moat scorecard/ Much needed!!

ReplyDeleteHi,

DeleteDo sign up if you are interested.

Thank you for the support.

Regards,

TUB

2018 Revenue of Target Group = 36.3 Million (I deem Dec 2018 till Mar 2019 to have no revenue in order to be conservative.) ==> Wrong because the Semiconductor business is still operating (by the china buyer). The revenue guarantee is just a way to pretend MFG from snatching away the existing customer from the semiconductor business. Imagine MFG contact all the old customers and tell them they are setting up a new semiconductor business, then the china side buyers will be buying an empty shell. So revenue is 100% NOT zero.. Just to clarify :)

ReplyDeleteHi David,

DeleteThanks for the comments. I understand the business will be running but I cannot get actual figures. Therefore I rather be super conservative in this case.

Regards,

TUB