A Company To Hold During A Recession!

As stated previously, I wanted to write about this Singapore civil construction firm that is almost a net-net firm, which I currently already owned.

Although it is in a very unpopular industry that is deem to be low margin, but there are a lot of positive for the company going on right now!

The reasons are as follows:

1. A Profitable Company with its Market Cap is below its Net Current Asset Value.

This meant that its current asset is able to cover all its liabilities and is still very close to its share price! In addition, the company is profitable with no debt.

|

| Balance Sheet taken from its latest HY report |

2. Almost S$1 bn of order book right now!

The company was recently awarded 2 civil construction contracts that bought their order book to almost S$1 bn!

Civil construction projects maybe deem to have low margins. However, this order book should be seen as a positive tailwind given the company is an experienced civil contractor and these projects are tied to the Singapore Government and can generate a good cash flow in the uncertain times ahead!

| Project Announcement |

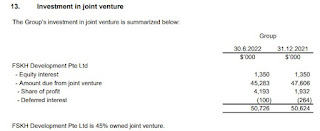

3. Joint Venture Property Project Has Been Fully Sold!

As interest rate are rising, there is uncertainty in property projects being able to be sold off in the future. However, the company has already fully sold off its joint venture projects. This meant that the joint venture investment will be returned along with its profits!

This meant that the company will be sitting on over S$150m of cash soon!

| JV Project Fully Sold |

|

| JV investment |

4. Dividends!

The company has a record of giving dividends annually. In 2017, it even gave a dividend of S$0.125 that resulted in the company hitting a record high share price of S$0.62!

I remember, that was the time the company was flush with cash, and it is in a similar situation now!

|

| Dividend Record as per SGX website |

|

| Share Price as per Google |

At the end of the day, this seems like a company to own with the uncertain times ahead!

Oh...the company is Hock Lian Seng Ltd (SGX: J2T)!

I know there are some overseas value investors whom are interested in this write up. So the financials are linked here if you are interested to read it yourself!

If you had read till here and I have value-added to your investment journey, please support by clicking into the Google Ads if it interest you!

Appreciate!

Stay tuned for the next write up!

Thanks for the insight! But price seems flat and depressed

ReplyDeleteHi Bfire,

DeleteNo problem. Price is flat will also be a good tailwind in a recession because everyone that wanna sell will have sold. But in the world of Singapore companies, normally when a huge dividend comes, the price will have followed, patience is key.

TUB