TUB Assert - Beng Kuang Marine's Financial Resurgence

Still Vested

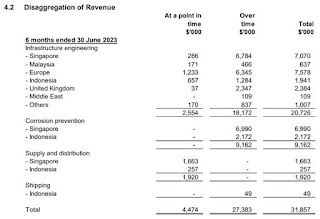

I have previously covered Beng Kuang Marine in several articles, and I'm excited to share the latest update on their financials. On August 11, 2023, the company released its six-month financial report, highlighting two crucial points:

(1) Remarkably, the company has achieved a turnaround and generated a profit without relying on gains from shipyard sales. This outcome exceeded my expectations. The thriving FPSO and FSO market during the period of high oil prices, surpassing $100 per barrel, undoubtedly contributed to this success.

|

| Source: HY2023 Financials |

As quoted from the press release, "The Group’s IE continues to be its core revenue generator with revenue growth of 7.5% in 1H2023, with its 51%-owned subsidiary, Asian Sealand Offshore and Marine Pte Ltd (“ASOM”), being the main revenue contributor of IE’s 1H2023 sales as a result of increased business volume from higher demand for FPSO and FSO contracting services...ASOM has diversified its geographical scope of work from South Africa to South America and China...as at 30 June 2023, ASOM has an order book of S$8.8 million."

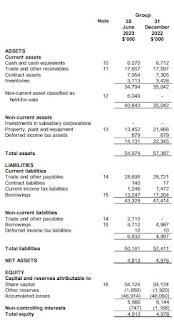

(2) Additionally, the Group has entered into sale and purchase agreements for the sale of land in Batam, Kabiland, and a tugboat, resulting in aggregate proceeds of S$19.5 million. As of June 30, 2023, the assets held-for-sale related to these transactions amounted to S$6.05 million. If all the funds are used to pay off debts, the net worth of the company will increase by $13 million, surpassing $17 million. Notably, the current market capitalization is just over $15 million. This implies that the price-to-book value ratio will fall below 1.

|

| Source: HY2023 Financials |

|

| Source: SGX website |

Conclusion

Considering the profitability achieved and the price-to-book value of less than 1, there is a strong possibility that when the full-year results are released, the share price will experience a significant increase as investors recognize this hidden gem of a turnaround.

Stay Tuned for the next TUB Assert.

Comments

Post a Comment