Don't FOMO into Netflix

Netflix (NFLX) reported strong third quarter results that saw its share price increase significantly. Prior to the earnings announcement, I had planned to initiate a position in Netflix but was anticipating weaker performance given recent headwinds facing the company. Unfortunately, as often happens, the market surprised me and I missed an opportunity to invest. And to make matters worse, on the same day I decided to sell put option on Tesla, which in hindsight proved poorly timed. It seems my market intuition left much to be desired.

Regardless of missing this particular opportunity, I think it's prudent not to hastily FOMO into Netflix merely due to recent share price momentum. There are ongoing labor disputes that meaningfully will impact Netflix's cost structure in 2023 and 2024.

- Specifically, the Writers Guild of America strike from May 2023 to September 2023. Significant changes have taken place in the realm of High Budget Subscription Video on Demand where there has been a substantial rise in foreign streaming residuals and the introduction of new streaming bonuses based on viewership statistics. This particular sector now focuses on creating feature-length projects exclusively for streaming platforms, with budgets exceeding $30 million.

- Meanwhile, SAG-AFTRA actor negotiations that began in July have yet to conclude, with unions seeking a levy on each subscriber and also more on residual payment which streaming services do not provide.

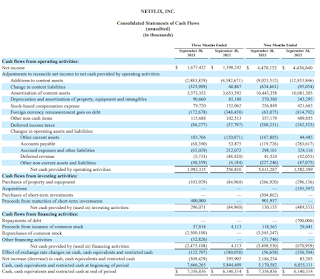

Notably, during the just-reported third quarter (Q3 FY23), Netflix incurred no additional costs associated with settling either dispute. Additions to content assets stood at a mere US$2.8 billion, well below the second quarter outlay of US$3.68 billion and meaningfully under the year-ago period's US$4.5 billion. At the same time, Netflix repurchased an impressive $2.5 billion of its own stock, accounting for 76% of all buybacks initiated over the previous nine months.

|

| Netflix Q3 FY23 Cashflow Statement |

While strong cash generation enabled these capital allocation decisions, I find it perplexing that Netflix chose not to pay off its debt and instead opted to use the additional funds for buybacks. Furthermore, comments from the CFO about the advertising tier not significantly impacting growth seem aimed at justifying the well-timed buyback rather than objectively portraying the business outlook.

In conclusion, I remain interested in Netflix as a long-term investment opportunity. However, with significant labor negotiation overhang and production spend set to meaningfully increase next year, the risk/reward profile at current levels gives me pause. I'll wait for a wider margin of safety rather than chase recent share price momentum.

Here is an article on the discounted cashflow valuation on Netflix written by Brian.

Stay Tuned.

Comments

Post a Comment