Optimizing Credit Card Rewards Through Strategic Card Usage Consolidation

For many credit card holders like myself, it can be challenging to keep track of multiple cards offering a variety of rewards programs. Frequent flyer miles, cash back, rewards – the landscape of credit card perks is vast and ever-changing. In the past, I found myself holding onto cards long past their usefulness simply due to their rewards program. However, as I took time to analyze my recent card usage patterns, I realized a more strategic approach was needed.

Rather than accumulating a disorganized collection of cards with modest, scattered rewards, I decided to consolidate my spending onto a single card optimized for my regular expenses. This would allow me to maximize the rewards I earn in a way that provides tangible value. Previously, accumulating rewards slowly through small cash back amounts or occasional bonus categories didn't give me a strong sense of return on investment. I wanted rewards that could be redeemed for experiential goals, like overseas travel.

|

| SCB Journey Credit Card |

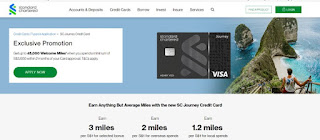

After reviewing the programs available, I settled on the SCB Journey credit card (Not a sponsored post, no link here) for its outsized rewards on transport and grocery purchases, comprising a large share of my monthly spending.

|

| SCB Journey Credit Card T&Cs |

You can also read this Seedly post to understand the merchant codes.

Earning 7.5 reward points per dollar in these categories translates to 2.5 Krisflyer miles earned – allowing me to accumulate flight awards every couple years with disciplined on-card spending. By focusing exclusively on this card, I avoid the fragmented approach of the past where rewards balances grew slowly across multiple accounts.

Strategic credit card management, like wise investing, is about optimizing potential returns. For me, consolidation onto a single rewards leader provides clarity, discipline and the ability to redeem miles for memorable experiences – achieving true satisfaction from my credit card usage. With a plan in place, I'm looking forward to seeing the rewards add up over time through consistent spending in bonus categories.

Here's my attempt at an article on personal finance. If you find it helpful, feel free to share it with others and click on the advertisement!

Stay Tuned,

Comments

Post a Comment