My Strategy On Buying Of Bonds

Updated: As pointed out by other readers, we can also choose to invest in ABF SG Bond ETF. It is an ETF bond fund in Singapore. It tracks a basket of high-quality bonds issued primarily by the Singapore government and quasi-Singapore government entities.

This is a request from my reader/subscriber of Fundamental Scorecard website.

This is a request from my reader/subscriber of Fundamental Scorecard website.

She wanted to diversify into bonds. But she has not much

idea about bonds other than Singapore Saving Bonds (SSB).

To clarify, my knowledge on bonds are very shallow.

Pardon me if I made any mistake in writing of this article. Feel free to comment on any mistake I wrote in the comments below.

For me, I seem to have a similar issue with my reader. My

portfolio consist of about 40% to 50% cash at the start of 2018 (After

restarting my portfolio and selling various counters at the end of 2017) and I

wanted to find another way to diversify. This is because I felt the equities

market is slightly too bullish for my current liking.

If you want to understand more about SSB, Singapore GovernmentSecurities (SGS) and Treasury bills (T-bills), you can read about them through the write ups by Dr Wealth in the links attached.

SSB, in my opinion, is like a 10 year fixed deposit with a

step up interest rate that you can withdraw at any point in time. But when you withdraw,

cash will only be received the following month and interest earned will be

pro-rated.

On the other hand SGS and T-Bills is more like a commercial

bond that is subject to market conditions – in this case, the Singapore economy

– and it can be purchased within SGX.

There are also many companies’ bonds sold within SGX, and

these are subject to market conditions as well as how the companies are doing.

For this write up, I will not be going into detail of how to buy and sell bonds. Rather, I will be talking about what I believe

could affect the bonds market and what kind of strategy I will take.

Factors that could affect the Bond Market:

Point 1 – Coupon Rate

Coupon Rate is the interest rate of each bond. It is

normally fixed throughout the tender. In equities, this is similar to dividend yield. But dividend

yield is not fixed.

Point 2 – Interest Rate and Bond Price.

There is always an inverse relationship between interest

rate and bond price.

Let me quote an article by Forbes: “...To explain the

relationship between bond prices and bond yields, let's use an example. First,

let's disregard today's artificially-induced interest rate environment and

assume you've just purchased a bond with a maturity of five years, a coupon of

5.0%, and you bought it at par (i.e.; 100%), investing $1,000. At this point,

your bond is worth exactly what you paid for it, no more and no less. Also,

just to be clear, you will receive annual interest of $50 ($1,000 x 5.0% =

$50), plus a return of your principal at maturity. However, the market value of

your bond will fluctuate after your purchase as interest rates rise or fall.

Let's assume that interest rates rise. In fact, let's assume they rise to 7.0%.

Because new bonds are now being issued with a 7.0% coupon, your bond, which has

a 5.0% coupon, is not worth as much as it was when you bought it. Why? If

investors can invest the same $1,000 and purchase a bond that pays a higher

interest rate, why would they pay $1,000 for your lower-interest bond? In this

case, the value of your bond would be less than $1,000. Hence, your bond would

be trading at a discount. Conversely, if interest rates were to fall after your

purchase, the value of your bond would rise because investors cannot buy a new

issue bond with a coupon as high as yours. In this case, your bond would be

worth more than $1,000…”

Point 3 – Bonds Prices’ Par Value

There is a need to understand what the issued price of the

bonds is (which is the par value). This is because this will also be the amount of cash you will get back when the bond matures. For SGS, it is normally based back to $100. For companies’ bond

price, it should be $1.

Point 4 – Bonds Prices Are Affected by the Underlying Country’s Economy/Companies’ Outlook

Regardless of the coupon rate, bonds prices are also

affected by the underlying countries’/companies’ outlook.

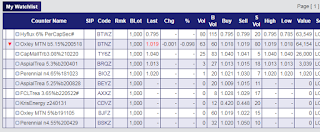

A look at the top 20 Bonds counters below:

|

| Taken from SGX as of 8 Jan 2018 |

Companies, such as KrisEnergy and Hyflux, whose bonds have

fallen below the par value due to their current business outlook and the market

has punished them despite a high coupon rate.

Point 5 – Bond Holders has the priority over Equity Holders

In the event a company wind up, a bond holder has the right

to their cash prior to equity investor. Thus, bonds is deem as a safer product

than equity investment.

Point 6 – T&C of a Bond Can Be Amended

This basically relates more towards companies’ bond.

However, this does not meant that a company can just anyhow change its bond’s

T&C as and when they like.

But during the oil and gas crisis, when many of the

companies couldn’t pay their bonds holders, these companies will hold meetings

with the bond holders to ask to waive certain conditions or to allow extension

of the bonds.

Upon the approval from the bondholders, the company will

then proceed to make the following changes to the bonds T&C.

My Strategy

Do note that I am diversifying into bonds, mainly because of

my huge cash holdings and the bullish stock market. My main objective is to earn

a bit of return while keeping the bulk of my cash free from any significant

risk taking. Do note of my following criteria:

1. Short Term Holding

My holding of these bonds are not meant to be a long term

investment (over and above 1 year). I intend to get back these cash in a few

months’ time (within 2 to 3 months) and invest them into the equities market again.

2. Interest Rate Set to Increase in 2018

Interest rate will also definitely increase in 2018 unless

Fed changes their mind. Therefore, do note that bond prices tend to fall in the

long run.

3. Ignore All Companies’ Bond

I also tend to ignore the companies’ bond market. This is

because based on the top 20 bonds listing on SGX as per the picture above, it

seems that established firms will only provide a lower coupon rate, which could

potentially be the same as the fixed deposit rate in the long term IF the interest

rate continue to rise.

Furthermore, for companies with bond prices at below 1, it

seems that it might be better to buy their respective equity since you are

already taking the risk in investing in the company. The return on investment will be higher

with the same amount of cash invested (Assuming the current share price is lower than

the bond price in SGX).

Conclusion

With the above criteria established, I will be considering buying SGS

with bond prices set below $100 that will be matured soon. In addition, I have

already invested a part of my cash holdings in SSB prior to writing this

article.

I hope this satisfy my reader’s question! In addition, if I have stated any information wrongly in this write up, please feel free to comment about it!

If you still have more questions, free feel to come

for our first Face-to-Face Ask Us Anything session on 16 January 2018. SimpleInvestor SG and I will answer any of the questions you have on investment or

our Fundamental Scorecard website.

Oh... and do remember, please like our Facebook page (T.U.B Investing) and follow me on InvestingNote.

Do you buy new SGS? If so, you would not know the coupon rate until the auction is over.

ReplyDeletestarlight

Hi Starlight,

DeleteNope. I did not consider new SGS because I am looking at short term return/protecting my cash amount only.

Hope this clarify and thanks for informing!

Regards,

TUB

Can also consider ABF Bond Index, which is a mix of SG government bonds and high quality company bonds. Volatility is very low, with near 0 correlation with the general stock market.

ReplyDeleteHi Seeking Private Returns,

DeleteThank you for commenting again.

Yup. I actually updated it. In fact this ETF has fell recently and it look like a good time to enter.

Regards,

TUB