To call the current market situation turbulent would be an understatement. And to understand why, you might want to read my articles “What is happening in the market?” followed by “Recession coming”. To wade our way through this impending storm, we need a plan. Here is mine.

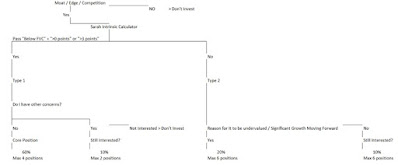

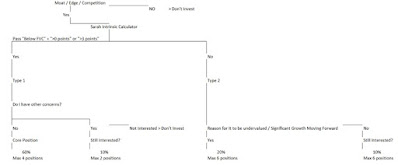

My primary objective will be to keep my portfolio as far out of the red as possible with companies that can take a hit, whist keeping an eye out for companies that may shoot to the moon after recession dwindles. To do that, I will be using 3 filters to differentiate companies into conservative, enduring ones and potential moonshots. If you’re on time, you can take a look at the diagram below. It summarizes my entire approach. Otherwise, a lengthier explanation can be found below the diagram.

|

| The Roadmap |

Filter 1: Find Companies with a Competitive Edge

Almost every company is going to have to take a hit, but only the ones with a competitive edge in their industry are going to be able to survive the hit. This could mean that the company has the greatest market share, possess a certain proprietary product or operates in an agile fashion that allows them to pivot extremely flexibly and quickly. There is no hard and fast rule here, and you will need quite a bit of domain knowledge to decide what your criterion for “competitive” is. Hence, I will suggest sticking to industries that you are very familiar when trying to pinpoint “competitive” and durable companies for your portfolio.

Filter 2: Find Companies with Ample Free Cash Flow

I am a strong proponent of financial analysis based off Free Cash Flow

(FCF). While there are a lot of other metrics to use, FCF gracefully and succinctly tells me if a company has more to work with than they currently need. This is especially important if a company is to survive during a recession where capital is most likely going to be low. In addition, I believe that Stock-Based Compensation

(SBC) is the hidden cost that warps a lot of financial analysis based on Free Cash Flow

(FCF). You can read more about my views on this

here. Naturally, I will only choose companies where there is FCF or FCF-SBC data available and focus on the ones with positive FCF or FCF-SCB. The larger a company’s war chest, the better.

Filter 3: Decide If These Companies Will Last

An industrial edge and financial surplus is great, but will these enough? I will use these 4 factors to decide that. In some cases, there will be a quantifiable number. This is arbitrary and you should tweak it according to your own preferences.

Factor 1: FCF-ex-SCB Valuation

The company’s current share price should be undervalued to their FCF-ex-SCB valuation. Here I am assuming that the company’s share price is an indicator of not just how valuable they are, but also the amount of FCF it is able to generate.

Factor 2: Current Sentiment

The economic recession can only dampen the short term market sentiment if the company's share price is significantly optimistic. Hence, I am looking at companies that are on a significant uptrend. Specifically, the company’s current share price must be at least 25% off its 52-week high.

Factor 3: Current Market Valuation

Price-to-earnings (PE), price/earnings to growth (PEG) and enterprise value (EV)/ earnings before interest, taxes, depreciation, and amortization (EBITDA) ratios of the company should be below market average.

Factor 4: Debt Load

The company’s total debt should be lower than its debt-to-EBITDA ratio by at least a factor of 3.5 times.

Companies that make it through all 3 filters will be categorized as Type 1, while the rest will be categorized as Type 2. Type 1 companies will help my portfolio endure the economic recession. On the other hand, Type 2 companies are potential “moonshots". This is especially so for the ones that are currently on the downtrend. They could either be really high-growth companies that are currently dipping and will dip some more when the economic recession hits. That would be prime time for me to invest, as these high-growth companies will soar if and when the recession eases up. Of course, there are other companies that are just not performing because of poor planning or other fundamental reasons and will most likely crash further during the recession. To differentiate these Type 2 companies will take far more thorough analysis which I might share in another article.

Given that times will be hard in the upcoming quarter or more, I suggest we take a more conservative approach to risk and lean our portfolios toward Type 1 companies. This can range from a 50/50 split to a 10/90 split, depending on your risk appetite. I will be taking a 70/30 split.

And that is my full roadmap to choosing companies. I hope you had a good read, thank you and I will catch you on the next article. Till then, good luck and good investing.

Stay tuned.

Comments

Post a Comment