This write up is expected to be a long. Thus, I have split it up into Part 1 and Part 2. Part 2 will be out in the next few days. Stay Tuned!

I owned FuboTV (FUBO) for sometime but I have never wrote about it.

It is a small cap stock and came out of a reserve takeover. It does not have a net profit or free cash flow since the reserve takeover - meaning it is hardly an inflation proof company. It is in the streaming business which is a super competitive - which will result in significant operating cost in order to stand out.

|

| FuboTV Inc. Logo |

Furthermore, it is definitely not an easy time to hold on to FUBO during the last 3 months. It was brutal with the share price falling from US$29 to US$9+!

|

| Screenshot from Finviz.com |

After reading the above and knowing that inflation/interest rate will rise will come, many of you will want to skip this company.

But I believe the time is ripe for me to write about the company - to consolidate my thoughts on FUBO.

In my opinion, I believe there is a high chance FUBO could 10X from here.

This article will be written as per the format. Then I will review at the main risk, the financials/numbers and the highlights that you may not know. Understanding The Business

FUBO is an data-driven “come for the sports, stay for the entertainment” streaming service. It started as a soccer-centric streaming service and is available in US, Canada and Spain.

It has also officially launched its sportsbook (for sports betting) in Nov 21 and is currently live in Iowa and Arizona. It has market access agreements in Pennsylvania via The Cordish Companies and Indiana and New Jersey via Caesars Entertainment Inc.

FUBO is moving forward along with these 3 major trends:

(2) Shifting of TV Ad revenue from traditional TV to digital TV;

(3) Sports Wagering - The online sports wagering market is expected to reach $155 billion by 2024 according to Zion Market Research.

.

FUBO has also acquired:

(1) Balto Sports in Dec 20 - a contest automation software to launch a free to play game offering;

(2) Vigtory in Mar 21 - a sports gaming company to launch its own sportsbook, as well as pipeline of market access deals, including a completed agreement with Iowa through Casino Queen;

(3) Molotov SAS in Nov 21 - a streaming company in France that provides a freemium model which leverages a free tier to drive user growth and upsell customers to premium add-on channel packages and is available in France, Burkina Faso, Ivory Coast, Senegal, Cameroon and Congo. This will help with FUBO international expansion;

(4) Edisn.ai in Dec 21 - an AI-powered computer vision platform with patent-pending video recognition technologies based in India and drive FUBO mission to create a more interactive and immersive live TV experience.

David Gandler is the Co-founder and CEO of FUBO. Prior to founding FUBO, he has worked at Scripps Networks Interactive, Time Warner Cable Media Sales and NBCUniversal’s Telemundo Media.

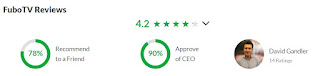

FUBO also has a 4.2 rating on Glassdoor with David having a 90% approval as a CEO (based on 14 rating).

|

| David Gandler, co-founder and CEO of FUBO |

|

| David Gandler Experience as per his Linkedin |

|

| Screenshot of Glassdoor Rating of FUBO and David Gandler |

Total Addressable Market (TAM)

As quoted from its 10K, "With more than 3.5 billion soccer fans worldwide, in addition to all other sports fans and TV viewers, we believe there remains a significant opportunity to expand internationally."

My opinion is that everyone will be interested in at least 1 or 2 sports, which meant that TAM is definitely much higher than 3.5 billion.

Competitor and FUBO Unique Edge

As stated at the start, FUBO is in a high competition sector as there are many streaming services out there.

However, I will not be considering connected devices such as Roku, Apple TV, Amazon Fire Stick or Google Chromecast as competitor since FUBO can be

found and watched on these platforms as well.

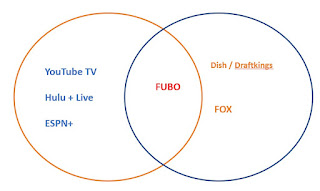

If competition is solely considered as the streaming services that have sports and entertainment, it will be Hulu+, YouTubeTV and Sling TV.

If the competition is solely considered as streaming services

(focus on sports) that has integrated sports wagering, there is almost

NO competition unless we include

Dish/DraftKings integration and

FOX.

Nevertheless, in my opinion, FUBO still stands out as (1) it is more like a "streaming first, sports wagering second" kind of service under the same company - which maybe more accepted and (2) could touch base with those that engage in causal betting which is the extended pool of customers.

Furthermore, (3) with its

seamless integration between the betting app and TV, FUBO will be providing a unique experience for customers and this will entice the customers to make a bet.

Compare the above to the experience of requiring to download another app from another company in order to make a bet - I believe there is still a certain resistant.

I view the competitive landscape is as per picture below:

FUBO has another unique advantage (4) of being the program distributor as well as the sports wagering firm, which will probably allow the company to have an easier time of getting its sporting betting license being approved by each US states.

Another interesting point is that FUBO has an

Ecommerce shop for its own exclusive branded merchandise. There is really not much appeal about this shop now since it sells only its own FuboTV merchandise. However, if the Ecommerce shop can appear on the TV to sell the sports merchandise of the 2 teams in a soccer match during the breaks - This could be amazing!

Therefore, with my opinions stated above, I believe FUBO has almost no direct competitor and has some advantages which will be hard to replicate if others tried to copy.

Management and Execution

As stated, David Gandler is a Co-founder of FUBO. When a Co-founder is the CEO, as compared to a hired CEO, there is a focus more on the long term than the short term. This will be more in line with the retailer investors.

With regards to management execution, there will always be updates on their next move/action (If you read all the transcript and David's interview) and they have always been able executed within the provided timeline.

An example is the launch of the FUBO sportsbook:

(As per the press release and news)

12 Jan 21 - Acquire Vigtory for its sportsbook technology and its market access agreements in the eastern part of the United States and the secured deal in Iowa through Casino Queen

(1 state in progress)

3 Mar 21 - Secured market access agreements for its forthcoming fubo Sportsbook in Indiana and New Jersey through Caesars Entertainment Inc

(3 states in progress)

15 Jul 21 - Completion of a market access agreement in Pennsylvania with The Cordish Companies

(4 states in progress)

30 Aug 21 - Secured a market access agreement in Arizona with the Ak-Chin Indian Community

(5 states in progress)

31 Aug 21 - Received approval from the Iowa Racing and Gaming Commission to offer advance deposit online sports wagering within the state of Iowa through a market access agreement with Casino Queen.

2 Sep 21 - Granted a Management Services Provider Certification from the Arizona Department of Gaming

3 Nov 21 - Official launch in Iowa

(1 state launched, 4 states in progress)

20 Dec 21 - Official launch in Arizona

(2 states launched, 3 states in progress)

As shown above, the management was able to execute the launch of FUBO Sportsbook within 16 months since the reverse takeover and launch its sportsbook in 2 US states within 1 year. In my view, this is expectational execution.

That's all for Part 1. Stay tuned for Part 2!

FUBO 100X is my only comment!

ReplyDeleteI hope you are right!

Delete