This is a continuation from Part 1.

Decided to release Part 2 earlier because there are just too much noise in the market. Its not that I don't give a thought to negative information, but most of them do not have fundamental view to support claims. Furthermore, Part 2 is where I explained more about my belief and views on why FUBO has a 10X potential.

With regards to Sports Wagering, I will like to add that:

20 Jan 22 - Fubo Gaming (the subsidiary that develop and distribute of Fubo Sportsbook) inked a multi-year market access deal with Houston Dynamo FC, pending legislation passing in the State of Texas to legalize sports betting. (2 states launched, 4 states in progress)

8 Feb 22 - Cleveland Cavaliers and Fubo Gaming Announce Ohio Market Access Agreement (2 states launched, 5 states in progress)

|

| Fubo Sportsbook Named the Cavs' Official Mobile Sports Betting Partner |

Imagination

On 7 Feb 22, FUBO market cap is US$1.46bn. It is impossible to reach 10X potential (Est US$14.6bn) based on just what FUBO currently offers.

But if FUBO can achieve the following, then the possibility of reaching 10X potential improves significantly:

1. International Expansion

FUBO is currently only available in US, Canada and Spain. The acquired Molotov is available in France, Burkina Faso, Ivory Coast, Senegal, Cameroon and Congo. That is only 9 countries around the world.

If FUBO wants to reach a larger TAM, it has to quickly expands at a faster pace, especially with World Cup coming up (More on this in the highlights).

International expansion is officially mentioned with the acquisition of Molotov in its shareholder letter as well as the press release. Understanding FUBO management, this meant that this is already in the works.

2. Sports Wagering gets Approved in More States And in Canada

FUBO Sportsbook is only launched in 2 states (Iowa and Arizona) and only up to a total of 7 states by the end of 2022, if there isn't any new announcement.

|

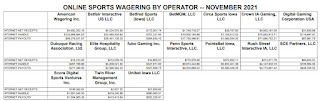

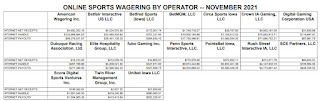

Nov 21 Net Receipts of Various Sports Betting Providers

|

|

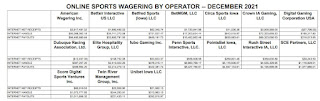

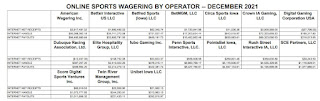

Dec 21 Net Receipts of Various Sports Betting Providers

|

|

Jan 22 Net Receipts of Various Sports Betting Providers

|

The margin for FUBO Sports Wagering is around 5.7% (US$19k in Nov 21), 14.3% (US$53k in Dec 21) and 9.2% (US$68k in Jan 22).

Based on the limited information above and

Iowa population being one of the lowest in US, I will assume that sports wagering in each state is able to make about US$50k every month, that will only be a maximum of US$4.2m

(50k X 7 states X 12 months) in 1 year.

Currently, there are

33 states in the US that has legalized sports betting. FUBO will need to get its hand on more market access agreement and launch the sportsbook at a faster pace.

I remember, in an interview, David once said that "after going through the whole process of obtaining approval to have provide sports betting in 2 states, it will be easier for FUBO to get more approval in other states since they had understood the whole process".

Furthermore, FUBO has many exclusive rights to soccer tournaments and leagues in Canada

(More on this in the highlights). If it can also get its hands into

Canada sports wagering, this will significantly increases its top and bottom line.

3. FUBO's own proprietary Adtech becomes a success

Currently, FUBO advertising revenue comes from partnership with The Trade Desk and Magnite. But as per 13 Jan 22

Needham Growth Conference, David said:

"...And there's going to be a very significant focus this quarter, the first quarter on ad tech, because while we've developed our video technology platform and a lot of the proprietary capabilities that you see, we have yet to do that on the ad side.

Frankly, I thought we were going to have more time to develop ads, because I didn't think we were going to grow as quickly. I knew we were going to grow quickly, but not to the degree we did, which means that our ad tech is actually not scaling, right? So, we have to -- we have a lot of third-party services that on days where we have a significant amount of traffic, it's just not scaling. And so we're going to be heavily focused on ad tech, because we want to unlock a lot of that value that's going to drive margins."

This is significant - because if successful, this could increase FUBO's margin in the advertising revenue since it does not need to pay to the Adtech platform as it becomes the platform itself.

4. Being Acquired

On the other hand, at the current market cap of US$1.46bn, FUBO definitely looks valuable as an acquisition target. It is easy to visualize the tech giants acquiring them to enhance their streaming offerings. However, this will probably not allow us to reach a 10X potential.

Risks

With some of the risks stated in Part 1, there is actually 1 main risk factor that I must acknowledge - It will be CASH BURN.

As per FY2020 10K, Net cash used in operating activities stands at negative (US$149m) with about US$29m of debt and US$134m of Cash.

As per 3rd Quarter of FY2021, Net cash used in operating activities stands at negative (US$143m) with about US$324m of debt and US$393m of Cash.

As per the latest

press release, the guidance for 4th Quarter of FY2021 is that FUBO will end with at least US$375m of Cash. Subscriber Acquisition Cost is expected to be at the low end of the company’s target range of 1.0-1.5x monthly Average Revenue Per User for the quarter.

As of FY2022, Molotov should also add to FUBO's Cash Burn.

If I will to guess how long FUBO's cash will last them? It will probably be around 1.5 years. Nevertheless, this will be clearer once FY2021 results are reported and guidance for Quarter 1 of FY2022 is provided.

Financials/Numbers

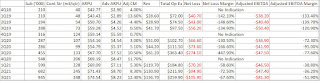

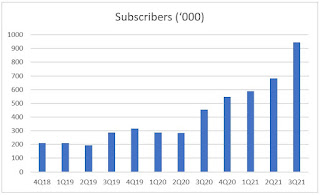

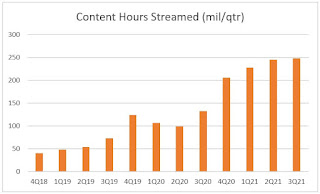

Rather than the financials, I will be reviewing the key operating metrics that FUBO always share in their shareholder letters.

|

| Key Operating Metrics in Shareholder Letter |

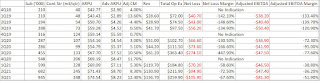

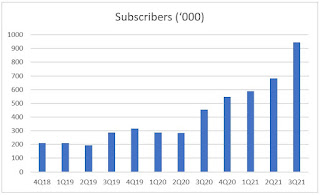

The information below are the figures and graphs of the key operating metrics from 4th Quarter 2018 till 3rd Quarter 2021:

|

| Key Operating Metrics in Shareholder Letter from 4Q18 till 3Q21 |

|

| Subscribers |

|

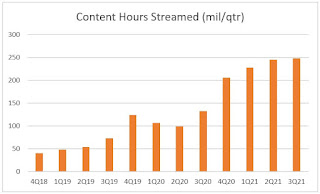

| Content Hrs Streamed |

|

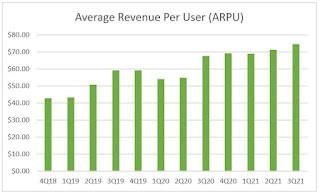

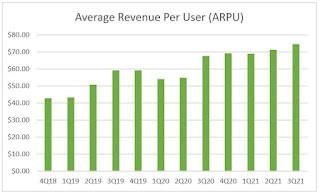

| Average Revenue Per User |

|

| Adjusted Contribution Margin |

|

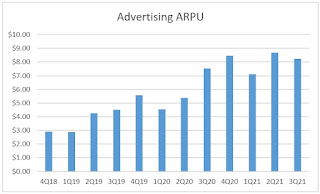

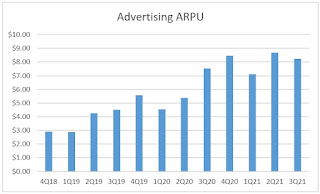

| Advertising ARPU |

From the metrics, the positive is that the figures are generally in an upwards trend and all metrics seem to have taken a boost after 3rd Quarter of 2020 - the point where the reverse takeover comes into effect.

Nevertheless, I will have hope for a more exponential improvement in terms of ARPU. This might have been due to the lack of scale in terms of advertising as well as sports wagering has yet to take off.

Thus, it will be important to review the upcoming 4th Quarter of 2021 and 1st Quarter of 2022 metrics - with sports betting coming on and also the scaling of FUBO's own Adtech.

Highlights That You May Not Know

1. FUBO bought Motolov for US$126m instead of US$190m

FUBO was able to closed the

acquisition early on 6 Dec 21 at a total cost of US$126m instead of the

announced US$190m. This should be seem as a positive sign as FUBO was able to acquire Motolov at a lower amount.

On the other hand, Motolov has over 10 million subscribers as of

Jan 20. Furthermore, in the

Sep 21 press release, it is stated to have

"Molotov’s unique offerings include its direct-to-consumer live TV streaming service and its advertising video-on-demand (AVOD) service, Mango, which combined total nearly four million monthly active users in France."

Assuming that Motolov have at least 16 million subscribers now (4x MAU), each subscriber will only have cost US$7.87 - can be deemed low as compared to FUBO's Subscriber Acquisition Cost.

2. Who is Edisn.ai?

Very little has been discussed about Edisn.ai. But this

article in 2019 will probably give you a view of what it can do.

As quoted from the article, "The Edisn.ai technology plugs into apps; during broadcast, the AI recognises players and begins to engage the audience to set the field for merchandising and brand building. It delivers contextual content on recognised players, enables users to share videos and interact with their friends on social networks without leaving the screen, and even helps with tickets for live games and merchandise."

Edisn.ai has also worked with an IPL team, an Australian esports team, an American football team, the Olympic sports federation business in Europe, and an e-sports company.

The question to ask is "Will FUBO makes the technology exclusive to FUBO only or also for other boardcasters?".

3. How Does FUBO Earn from Advertisement on Partners' Content?

From my understanding, FUBO will be allocated a certain amount of time on a channel on a per hour basis and FUBO will get ads to come in through the stream, before the stream gets to the video player or to your device, and FUBO will be able to add an in-stream advertisement. The user will not be disrupted by this and the transition will be smooth.

Correct me if I am wrong, but this sound similar to other streaming online platform with ads. Thus, if FUBO will to come up with its own Adtech, it will be able to make more Ad dollars even if the content is from their partners.

4. Soccer + Sports Wagering = Match Made in Heaven

On a personal note, I love playing (miss it ever since my daughter was born) and watching soccer. I also used to wager causally when I watch soccer, especially during World Cup and Euros.

|

| My Favorite Team: The 2007 Blackburn Line Up Against Chelsea |

Thus, I understand the appeal of FUBO in terms of watching soccer and sports wagering. This will totally enhanced the viewing experience during the soccer match especially for those who make casual bets.

For those interested in Soccer, do note that

World Cup 2022 will start 21 Nov to 18 Dec 22. As for the

CONCACAF world cup qualifiers, Canada has qualified for the World Cup 2022, while US is in 3rd place with 3 more games to go.

Once the World Cup 2022 arrives, especially if Canada and US have qualified, customers whom are watching these matches via FuboTV will have a high probability of putting a wager through the Fubo Sportsbook App. Therefore, enhancing their sports wagering net receipts during that time.

5. Exclusive Soccer Deal Rights

FUBO recently acquired the rights to:

(1)

Exclusive rights for a multi-year deal Coppa Italia and the exclusive English language rights for Serie A in Canada beginning Aug 21;

(2)

Exclusive home to the Premier League, England’s top soccer league, in the Canadian market for the next three seasons beginning in 22/23

(After Aug 22);

(3)

Exclusive U.S. rights through a 6-year sublicense with FOX Sports to stream select matches from UEFA. The deal kicks off with the UEFA Nations League™ in June 22.

Other than supporting the sports betting ecosystem, this may provide FUBO another stream of income which is sub-licensing some of these rights.

If they do not sub-license these rights, then this meant users will definitely need to subscribe to FUBO to watch these soccer matches.

6. Growing Soccer Fans in Canada

Since many of the exclusive deals involves Canada, it could be good to note that Canada has a

population of 38 million as of 2021.

Tokyo 2020 Olympics where the women's final was played between Canada vs Sweden, where Canada finally won the match and gold medal – was the

most-watched event on CBC during the Olympic stint – had 4.4 million Canadians across the country watching.

As per

article,

"...but an estimated 1.15 million Canadians tuned in to watch their side's World Cup qualifying victory over Mexico in November 2021 — the largest viewership on record for a live soccer broadcast of a Canadian match."

It seems like soccer is growing fondly in Canada, especially with the women's soccer team winning the gold medal in Tokyo Olympics 2020 and its qualification in the World Cup 2022.

This will definitely make a positive impact on the number of subscribers in FUBO probably in the 2nd half of 2022.

Conclusion

In short, I believe FUBO can 10X its current share price if it continues to execute well.

Once the subscribers + advertising revenue can breakeven with all the operating cost, I believe FUBO will try to obtain profitability and free cash flow, especially through sports betting. Multiples will tend to increase after that and the 10X potential will be uncovered.

Regardless, looking at the current share price, it seem like market is pricing FUBO for bankruptcy.

On the other hand, if we look at the plans ahead, the 2nd half of 2022 could be major for FUBO - Especially with World Cup 2022 and EPL Rights in Canada.

I was vested much earlier in FUBO and I am definitely in the red now. I expect the share price to range for a while (in view of the macro economic situation) and use options passively to reduce the "redness".

I will buy the dip only if resources allows.

If you have invested in FUBO and is in the red as me, I hope these 2 articles will value-add to your conviction to hold.

If you have yet to invest in FUBO, please do your own due diligence and review the facts that are written in these articles.

FUBO results may be released on 23 Feb 22.

Stay Tuned!

Comments

Post a Comment