I Reinvest In This Singapore Developer Again! - Part 2

This is a continuation of the previous article.

This will be my most important reason for reinvesting in Bukit Sembawang Estates Limited.

5. Hidden Value in Land Bank

As stated in this previous written article, there are hidden value within Bukit Sembawang.

Based on the information gathered below (2009 annual report and Wikipedia), Bukit Sembawang used to own plantations.

|

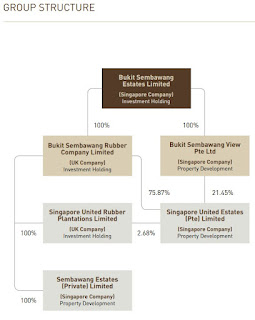

| Group Structure Breakdown as of FY2009 Annual Report |

|

| Screenshot of Lim Koon Teck's Wikipedia Page |

As of today, Bukit Sembawang is still holding onto these lands in Singapore and in the process of converting these agriculture lands to residential lands. These lands are hidden assets because they are not accounted for in the balance sheet.

However, do noted that these lands are reported in the 2021 annual report as per “Land in Seletar Hills Area” below:

|

| Properties Breakdown as per FY2021 Annual Report |

Since I am unable to fully appreciate the term of development properties in the balance sheet, I will assume all planned and completed properties are included in the figure.

Thus, the remainder land bank are:

(1) Lots 9425C, 251N, 3310V & 5353N MK 18 at Yio Chu Kang Road/Ang Mo Kio Avenue 5/ Seletar Road – 21,489 sq metre

(2) Lot 18415A/18416K/16449W MK 18 at Nim Road/ Ang Mo Kio Avenue 5/CTE – 48,857 sq metre

(3) Lot 9934W MK 18 at Ang Mo Kio Avenue 5/Nim Road/CTE – 15,244 sq metre

Total land bank not accounted for amounts to – 85,590 sq metre.

|

| Nim Collection New Sale Purchase Price as per URA Website |

Based on the lowest unit price (S$1072 per sq feet) on the URA website for new sale under the Nim Collection (Bukit Sembawang development within the vicinity) in 2020, the total estimated value for the remaining land bank:

85,590 x 10.764 x S$1,072 = S$987,623,694

Additional value per share = S$987,623,694 / 258,911,326 = S$3.815

A hidden S$3.815 in value within Bukit Sembawang!

Risk

Before I conclude, it is important to understand that all investment comes with risk.

There are 2 risks that I identified:

- Collapse of Real Estate price in Singapore

- Bukit Sembawang is unable to obtain the license to convert the agriculture lands to residential lands.

However, I will view them as low risks because (1) in these inflationary times, I have doubts the real estate prices will collapse and only 30% of Singapore's land is given for landed properties (which most of Bukit Sembawang development are landed properties). Furthermore, (2) Singapore is a small country with a growing population, more lands will be required for residential estates.

My Conclusion

In short, the reasons of reinvesting in Bukit Sembawang were mainly based on the basis of value investing and dividend investing – investing with a margin of safety that comes along with a high dividend yield.

Margin of safety relates to the current share price being close to the NCAV and there is a hidden value estimated to be 76.9% of the current share price. Furthermore, there is a high possibility that there might be a 6% dividend yield on top of the margin of safety.

Based on a Jun 2021 business times article, DBS has given the company a target price of S$5.92. It is still lower than what I will assume (My target price will be above 6, closer to 7), but this target price is still having at least 19% of margin of safety from today’s share price.

If you had read till here and I have value-added to your investment journey, please support by clicking into the Google Ads if it interest you!

Appreciate!

Stay tuned for the next write up!

Comments

Post a Comment