10X Potential: Digital Turbine Inc (Ticker: APPS) — Part 5

Super long post. Maybe a bit dry. But there is a little secret at the end of the post.

Apologies for the late write up on Digital Turbine Inc (APPS). Have to take some time to deal with website issues and to help take care of my daughter.

With the recent APPS results, I felt that there was an initial rush of joy which has died down recently. While going through my Twitter account, I also realise there are shareholders whom are getting jittery. I even understand that a prominent twitter investor has sold his whole position.

For this write up, I will be trying something different by having a deep dive into APPS financials and provide my perspective on the concerns that most of seem to have with regards to APPS financials.

|

| Image taken from Digital Turbine IR Page |

Before I get into the dry numbers, I will provide a summary of the positives of the recent quarter as per the transcript:

- Overall revenue is still 70% Android and 30% IOS.

- Synergy between APPS and the acquisitions is a major focus moving forward. Synergy revenue run rate approached 10% of overall Revenue. Common support services like HR, accounting, sales force and technology platforms are still integrating.

- APPS has over 800 million devices that their software has been installed on, including 68 million in this quarter.

- APPS Intention is to drive grow in other products such as Notifications, Discover Bar, FairBid, Offer Wall and Marketplace. For example, Smart Folder product grew by over 300% year-over-year.

- The partnership with Google will yield material cost savings over the next few years.

- Open App Markets Act received a bipartisan vote from the Senate Judiciary Committee. This would debundle the Google and Apple app stores from the operating system and offer consumer more choices to select from. This will further benefit APPS.

- On Telefonica - APPS has launched in a few countries with them. The plan for the next six months is going to be to expand that as part of the global contract that APPS has signed with them. All the devices that are shipped to them are SingleTap enabled. Thus, APPS is just in the process of ramping and scaling this relationship.

- Since Analyst Day and in 2.5 months, APPS has grown the advertisers on SingleTap platform from 15 to 50 companies.

- Moving into a licensing capabilities which is a SaaS-like model for SingleTap.

- Mobile Posse has over 10 million daily active users and APPS is just starting to get going with Verizon and AT&T, which are growth catalysts in the future.

- Samsung, one of their major partners, has a nice return to growth in US.

- Internationally APPS is also seeing a lot of the growth in overall devices moving forward.

Concern 1: Current Ratio below 1. Thus, APPS is unable to pay for the Current Liabilities supposed to be paid within 1 year

Based on SeekingAlpha data over the last 11 quarters, 7 of the quarters has been below 1. This has been more of a norm for the since acquiring Mobile Posse (Mar 2020). It is also important to note that the Current Ratio for the last 3 quarters (after the string of acquisition of Appreciate, Adcolony, Fyber) have become much worse off – amid on an improving trend.

| APPS Current Ratio Over the 11 quarters |

Basically, it seems that acquisitions has been a strain on the balance sheet.

However, in order to understand if the balance sheet is indeed in trouble, I will be reviewing (1) APPS cash conversion cycle over last 3 quarters and (2) the categories within the latest current assets and liabilities.

(1) Cash Conversion Cycle Over Last 3 Quarters

As per Fundbox, Cash Conversion Cycle is a metric that “how long it takes your business to convert cash into inventory, then into sales, and finally back into cash again. You calculate the cash conversion cycle by figuring out how long it takes you to sell inventory, how long it takes you to collect your accounts receivable, and how soon you can pay your accounts payable."

The website further explained that, "A good cash conversion cycle is a short one. If your CCC is a low or (better yet) a negative number, that means your working capital is not tied up for long, and your business has greater liquidity..."

| Cash Conversion Cycle as Per Fundbox Website |

In view that the main bulk of their expenses is License Fee and Revenue Share, I will be combining Accounts Payable and Accrued License Fee and Revenue Shares* to calculate Days Payable Outstanding.

*Note that I am unable to identify the difference between Accounts Payable and Accrued License Fee and Revenue Shares in 10Q or 10K, but I had identified that Product Development and Sales and Marketing are primarily salaries and benefit for their own talent, while General Administration are primarily non-cash items.

|

| APPS Cash Conversion Cycle |

So, over the last 3 quarters, Cash conversion cycle for APPS has been negative but on an reducing trend. This coincide with the Current Ratio being on an improving trend over the last 3 quarters.

To further explain a negative cash conversion cycle, this article on Menabytes website quotes that, “a negative cash conversion cycle means that it takes you longer to pay your suppliers/bills than it takes you to sell your inventory and collect your money, which, de-facto, implies that your suppliers finance your operations. As a result, you do not need operating cash to grow.”

In this case, APPS has been taking more time to pay their partners than it takes to sell their Adspace and collect the receivables. This mean that APPS partners are financing its operations and they can proceed to use their free cash flow for other purposes like “grow their business” or “pay down their debt”.

(2) Review of Latest Current Assets and Liabilities

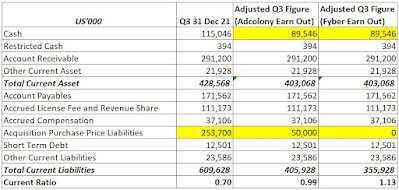

Based on the current assets and liabilities as of 3rd Quarter 2022 10Q, the most significant figure is “Acquisition Purchase Price Liabilities”.

As per 10Q, it is quoted as the following:

"The Company has recognized acquisition purchase price liability of $253,700 on its condensed consolidated balance sheet as of December 31, 2021, comprised of the following components:

• $204,500 of contingent earn-out consideration for the AdColony Acquisition

• $49,200 of contingent earn-out consideration for the Fyber Acquisition"

In addition, the above should be read in accordance with the quotes from the same 10Q:

“Subsequently to December 31, 2021, the Company drew an additional $179,000 against the New Credit Agreement. The proceeds, combined with available cash-onhand, were used to satisfy the AdColony Acquisition earn-out payment of $204,500, which was made on January 15, 2022.”

This meant that APPS has used $179m from the revolving facility and $25.5m from their own cash to pay for AdColony Acquisition earn-out payment of $204.5m.

“Under the terms of the Fyber Acquisition, the Company may have to make an earn-out payment of up to $50,000 through the issuance of a variable number of shares of its common stock or, under certain circumstances, cash, if Fyber's net revenues are equal to or higher than $100,000 for the 12-month period ending on March 31, 2022. As of December 31, 2021, the Company estimates the fair value of this payment to be $49,200.”

This meant that the maximum earn-out payment to Fyber is $50m and can be paid in shares.

Therefore, if I account for the above in APPS 3rd Quarter 2022 10Q, the current assets and liabilities should look like this:

|

| APPS Current Asset and Liabilities if Adjusted for Payouts |

Current Ratio will have improved to 1.13x after adjusting for both earn out considerations.

Concern 2: The Overall Debt Has Increase Too Much, Too Fast!

Another concern is that the total debt is growing too fast – a consequences of having 3 acquisitions in a short span of time.

Accordingly, to the 3rd Quarter 2022 10Q, APPS already has about $371m of Total Debt. Furthermore, if the additional debt required for the Adcolony earn-out payment is added to it, the overall amount will increase to an estimated $520m.

Furthermore, the 10Q also states the following:

“On December 29, 2021, the Company amended the New Credit Agreement (the "First Amendment"), which provides for an increase in the revolving line of credit by $125,000, which increased the maximum aggregate principal amount of the revolving line of credit to $525,000. The First Amendment made no other changes to the term or interest rates of the New Credit Agreement…

…Amounts outstanding under the New Credit Agreement accrue interest at an annual rate equal to, at the Company’s election, (i) London Inter-Bank Offered Rate ("LIBOR") plus between 1.50% and 2.25%, based on the Company’s consolidated leverage ratio, or (ii) a base rate based upon the highest of (a) the federal funds rate plus 0.50%, (b) BoA's prime rate, or (c) LIBOR plus 1.00% plus between 0.50% and 1.25%, based on the Company’s consolidated leverage ratio. Additionally, the New Credit Agreement is subject to an unused line of credit fee between 0.15% and 0.35% per annum, based on the Company’s consolidated leverage ratio. As of December 31, 2021, the interest rate was 1.99% and the unused line of credit fee was 0.30%."

With regards to the above statement, here are my assumptions:

1. I believe that APPS will not have the intention to pay off the revolver soon. Revolver seems to be similar to an overdraft line where a client just need to service the interest payment promptly and all the debt will probably roll over to the next year.

2. Based on the interest rate stated, the highest interest rate to be charged seem to be 2.25% pa. That will be $11.7m per year (against $520m) – which is about a maximum of $2.9m per quarter. The latest interest expense in their 10Q amounts to $2.19m – which APPS is able to satisfy easily.

3. If the expected future quarterly interest expense of $2.9m is compared to the amount of Free Cash Flow generated in the latest quarter (Estimated to be $36.5m), the Free Cash Flow can cover 12.5x the future quarterly interest expense.

4. Even if interest rate was to increase to 4% (maybe due to Fed increasing interest rate), the expected future quarterly interest expense will be only $5.2m. Based on the latest Free Cash Flow amount, it can cover up to 7x of this expected future quarterly interest expense.

Therefore, even with this increased in total debt, I believe that it will not hurt APPS as much. Nonetheless, APPS will probably have clipped their wings from further acquisitions till this debt is paid down more significantly.

My Opinion on Concern 1 & 2: This should not be a concern for a longer term investor. APPS balance sheet is stretched – but it will not hurt their operations since they have a negative cash conversion cycle and a high free cash flow – and with Current Ratio improving over the last 3 quarters and possibility in the next few quarters, the balance sheet will probably becomes better over the next few quarters.

Concern 3: Low Gross Margin

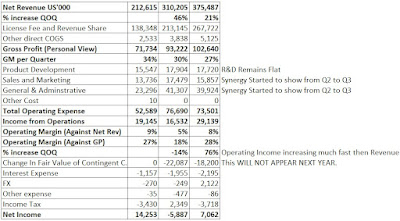

Low Gross Margin seem to be another of investor’s concern. The margin has been, again, impacted by the acquisitions as shown in this breakdown below:

|

| APPS Gross Margin |

|

| APPS Gross Margin Breakdown |

However, before you jumped into any conclusion, let me explain on my thoughts:

APPS may have been unable to clearly define the breakdown in cost as synergy arises – For example, if T Mobile comes in requesting for an video advertisement to be made (Adcolony) through the digital turbine exchange (Fyber) and the advertisement is shown on a device with SingleTap (Appreciate/Digital Turbine) – how will APPS be breaking down the revenue share allocation?

That is why I believe it is harder for APPS to track these revenue breakdown, these revenue sharing and license fee as synergy arises – resulting in the breakdown of a reduction in Gross margin on existing business as well.

This was also communicated through the transcript that to grow more, they can no longer track the businesses separately. Next quarter, they will stop tracking the businesses separately.

If this combination of business is inferred further and APPS combined the services, once APPS signed a new contract with the OEMs or Service providers, the revenue share portion may reduce and eventually the gross margin will improve on an overall basis.

The CFO has also communicated that the gross margin will improve over the next few quarters.

On their analyst day, it is projected to be 35% in the long term.

|

| Long Term Growth Target as per Analyst Day |

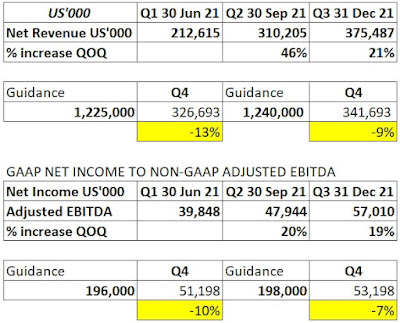

Concern 4: Lower Guidance In Next Quarter

|

| Lower Guidance For Next Quarter |

|

| Earning History as per SeekingAlpha |

My observation is that APPS has been constantly beating the target except for a handful of quarters and every 4th quarter is always a smaller beat.

Concern 5: The GOOGLE ISSUE

I will not be writing on this if not this article will be really too long. But rather to keep everyone in the loop, this was explain very well by @techdeepdives and @GreenhavenRoad.

My Opinion on Concern 5: Not a concern. In fact, it benefits APPS.

My Conclusion

In short, I believe we should continue to give APPS more time (at least till end of FY2023) to execute their plans. If these are executed well, better numbers will show up in their financials.

In fact, I shall let you in on a little secret I found out:

|

| Secret is in the income statement |

Basically, synergy has started to show from Q2 to Q3 and R&D remaining flat. Operating Income is also increasing much faster than Revenue. Finally, expect GAAP EPS TO SHOOT TO THE MOON NEXT YEAR - after removing all the earn-out.

William Stone had sold some shares in apps. Is that a sign of no confident?

ReplyDeleteHi James,

DeleteThanks for your comment.

Personally, I dont think so. It seem more planned or required kind of sale.

Regards,

TUB