10X Potential: FuboTV (Ticker:FUBO)—Part 3a

Prior to reading, do note that if there was any difference in information between this article and my previous write up (Part 1 and Part 2), then information in this article will take precedence as I may have new opinion or new information.

|

| Picture taken from TechCrunch |

FUBO has just released their 4Q21 financials on 23 Feb 2022.

In this article, I will be writing on "What You Knew" and "What You Might Missed Out".

Here is a summary of "What You Knew" - taken from shareholder letter and transcript:

Financials/Subscribers Count (Excluding Impact from Molotov)

- Total Revenue has increased 119% year-over-year to $637 million.

- Added approximately 185,000 net subscribers, bringing our total subscribers to over 1.13 million.

- An increase of 106% year-over-year compared to just 38% growth for the entire virtual MVPD market over the same period.

- Ended the quarter with $379.4 million in cash.

- With respect to the increased Subscriber Related Expenses (SRE), FUBO has added some regional sports networks and sports rights, which are 1-time expenses. Going forward, this expenses will deleverage on a same-store basis.

- FUBO is an aggregation service with an ambition to be the largest provider of live television in the world.

- Launched Fubo Sportsbook in two states, Iowa and Arizona with over market access deals in 10 states (Including Iowa and Arizona).

- Earn over 2 million of handle.

- FuboTV don't plan to compete with DraftKings and FanDuel since it has over 1 million customers and over 10 market access licenses.

- Expect to launch Fubo Sportsbook in additional markets soon.

- Going after the causal bettors

- 30 states live or passed legislation to allow sports wagering while over 20 states allow mobile betting.

- Strategy is the flywheel effect of the integration between our sportsbook and video experience in those states FUBO is in

- Ad revenue grew 98% year-over-year and accounted for 11% of total Revenue in the quarter.

- Repeat advertisers’ spend grew 170% in 2021, with increased spend among our top five advertisers between 3x and 10x and a meaningful increase in the number of advertisers spending above $1 million each.

- CPM is up to about $22.

- Focus on the ad tech side since fourth quarter and issues will completely resolved within the next call.

- Top 10 advertisers through January are already up triple digits and the ones that are down are frankly advertisers that are less than $5,000 in terms of spend.

- Molotov is the number 2 app in France, behind Netflix.

- Having 185,626 subscribers attributable to this quarter (Should be the paid subscribers)

- $1 million revenue impact since completion of acquisition only occurred on 8 Dec 2021

- Molotov contributed $0.2 million revenue impact in terms of Advertising.

- Guidance will be broken down into North America (US and Canada) and Rest of World (Spain and Molotov).This guidance does not include any projected revenue from online sports wagering.

- North America Streaming Q1 2022 - Projected revenue of $232 million to $237 million and Guidance of 1,028,000 to 1,033,000 subscribers.

- Rest of World Streaming Q1 2022 - Projected revenue of $3 million to $6 million and Guidance of 235,000 to 240,000 subscribers.

- North America Streaming FY2022 - Projected revenue of $1.8 billion to $1.9 billion and Guidance of 1.5 million to 1.51 million subscribers.

- Rest of World Streaming FY2022 - Projected revenue of $15 million to $20 million and Guidance of 270,000 to 280,000 subscribers.

- Over the long-term, Churn range to 4% to 5% range.

- There will be an investor day in the next few months and more will be revealed.

Here is "What You Might Missed Out":

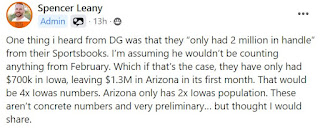

1. The Possible Breakdown of the 2 million handler (+positive)

For the uninitiated, handler is the gross amount of sports bet that were made on the Fubo Sportsbook Platform.

As per the Fubo Stock Investor FB Group, there was this comment made by Spencer Leany. He pointed out that the gross handler in Arizona should amounts to $1.3M - which is 4x Iowa's handlers while population is only 2x Iowa's population - which is very positive!

|

| Screenshot as per Fubo Stock Investor FB group |

Furthermore, based on my last post on FUBO, the estimated net receipts should amounts to around 7% to 10% of the gross handler amount. This meant that for the 2 states that has launched Fubo Sportsbook, the net receipts may estimated to be between $140k to $200k per month.

2. Additional Information on Molotov (+positive)

Similarly, Spencer Leany made another comment on Fubo Stock Investor FB Group with additional information on Molotov.

|

| Screenshot as per Fubo Stock Investor FB group |

Again, for those that do not know, Molotov has a free and paid version. Thus, the subscribers stated must have been paying customers. The 4 million monthly active users might be the number of users on the free platform.

3. Comparison of Key Metrics for 3Q21 with 4Q21 (-negative)

| Comparison of 3Q21 against 4Q21 |

4. Guidance For Subscribers For 1Q22 is lower (-negative)

Apparently, Guidance for North America subscribers for 1Q22 is 1.028 millions to 1.03 millions, when subscribers for 4Q21 is 1.13 million.

This was explained as a seasonality factor that Q1 has always been historically lower than Q4.

The above explanation is true for 4Q18 to 1Q19 (flat subscribers growth at 210k) and for 4Q19 to 1Q20 (10% negative drop in subscribers), but untrue for 4Q20 to 1Q21 (7% subscriber growth).

Some may comment that, between 4Q20 to 1Q21, the subscriber growth might still be related to the pandemic/lockdown. Thus, it could be a 1 off event.

Regardless of the reason, I believe this should also be deem as a negative.

Nevertheless, in the latest transcript, there is a lot of mention that FUBO having over 1 million subscribers. It seem like that is a milestone in itself - probably for data collection and analysis. Since 1Q22 guidance is still above 1 million subscribers, investors should just stay wary but not lose sleep over it.

I will pause here for the moment, if not the article will be too long. The next article will be release tomorrow at 9am (Singapore Time) and there will definitely be more value-added information for Fubo Investors!

Stay tuned!

Comments

Post a Comment