10X Potential: FuboTV (Ticker:FUBO)—Part 3b

This is a continuation of the previous article.

The more interesting findings are here - and also my value-added opinion.

5. Income Statement Calculation (+positive)

|

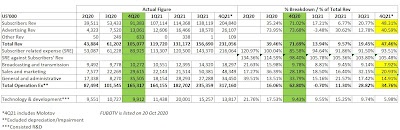

| Comparison of Income Statement QoQ |

In view of the breakdown of the income statement and comparing them Quarter over Quarter (QoQ), it still seen like the figures remains volatile. After all, Fubo is only listed on 20 Oct 2020 (on 3Q20), and the first actual financials should be 4Q20, which meant only about 5 quarters of financials has been released.

By reviewing the comparison of the Income Statement QoQ (Note that non-cash items are not included. Technology and Development expenses are deemed as positive growth. Thus, separated from the calculation), do note the following:

- Total revenue has been growing at a faster pace QoQ since 2Q21. But the great improvement occurs from 3Q21 to 4Q21 due to the significant growth in subscriber revenue and advertising revenue.

- 4Q21 was also the first quarter that the growth in total revenue has been higher than the growth in the stated total expenses.

- The above was a result of better growth in total revenue with all other expenses growing at slower pace in 4Q21.

- The only expenses that grew faster was SRE. This was explained in the transcript that its due to acquiring of rights (EPL in Canada, UEFA National Team Football and UEFA European Championship Matches Through FOX Sports) but these rights were only announced in Jan 22. Did they frontloaded the expenses? 4Q21 seem to be packed with information on the sportsbook and acquisitions.

- Nevertheless, the transcript also explained that these are 1 time cost - meaning SRE in the next quarter will be much more lower!

6. Streaming Platform Do Not Have Advertisement (+positive)

As streaming platforms without advertisements, such as Netflix and Disney+, are popularized, it creates a void for advertisers who used to advertise through TV advertisement.

Obviously there are already numerous ad-supported platform, such as YouTube and Pluto TV.

However, my opinion is that this void should be large enough (Just look at the subscribers for these platforms below) for FUBO to fit in as it scales its Adtech by end of 1Q22.

|

| Information taken from Wikipedia |

Conclusion

Overall, in view of 4Q21 results and the information gather regarding the next quarter, I believe there are more positives than negatives - which could creates some surprises and reverse a downward trending share price.

Over the long term, FUBO - being a news+sports content aggregator with entertainment content, free to play games and a sports betting service - remains unique in its space WITHOUT any direct competitor yet.

The main risks continues to be cash burn and probably if the subscribers falling below 1 million for more than 1 quarter.

As of the latest CEO interview with TD Ameritrade Network, the breakeven/profitable number of subscribers is stated to be 3 million. Therefore, FUBO should be able to hit this target within the next 2 to 3 years if the execution continues to be on target.

If you had read till here and I have value-added to your investment journey, please support by clicking the Google Ads if it interest you!

Appreciate!

Stay tuned for the next write up!

Comments

Post a Comment